How to Efficiently Scale With Capital

The goal of most startup companies is to achieve growth and profitability. However, the process of achieving those goals can be different for every company. The key to long-term success for most startups is to scale with efficiency, but that is not always easy. I recently read an interview by Alan Olsen, CPA and Managing Partner Greenstein, Rogoff, Olsen & Co., LLP a regional CPA firm of Montgomery Kersten, an angel investor and Independent Board member of several startups in Silicon Valley. Alan mentioned to Monty that many well-known startup companies have a reputation of burning through a lot of cash quickly. So Alan asked him how he helps companies scale and balance spending with growing their profits to a break-even point?

Old-Fashioned Approach

Monty said when it comes to scaling he is much more old-fashioned than many of the current crops of big-name startup companies, including Uber, which raised huge amounts of funding and have a massive marketing footprint. He has nothing against what these companies are doing. But Monty believes in capital efficiency and building huge shareholder value with small injections of financing. “I like the old fashioned way of modest capital, great productivity, profitability; conserve and build cash, after you have to burn it for a short period of time.”

Startup Bubble Time?

Alan asked Monty if we were currently in a startup bubble? “Everybody has their own view. I strongly feel that we are in a startup bubble. We’ve had a record amount of venture capital dumped into companies that aren’t profitable and that aren’t having exits. We have almost no IPOs and many fewer acquisitions and a whole lot of unicorns with no way out for investors. I think there’s a big bubble that’s going to pop here and I think Silicon Valley traffic patterns are going to get easier for our commutes in the next year.”

More IPOs Needed

Alan asked Monty about the fact that there are no exits? “It’s a very, very serious problem because the venture capitalists promise their investors returns that are liquid cash. They have to return cash or public stock to their limited partners, as a way to pay them back and reward them with returns on their capital. If they have no acquisitions of their own investments and they have no IPOs they don’t have any value yet, beyond just the paper stock certificate that they can give back to their limited partners. So there is an imperative to break the log jam in IPOs and to have acquisitions happen more frequently.” Monty foresees a revisiting of the dot.com bust; not so much in dot.com businesses today but in young startups that have raised too little and spent too quickly. Those companies that have too thin a business model and didn’t have a plan to win customers and turn profitable in time could be in trouble. “I think you’re going to see a lot of washouts intentionally let go by the venture capitalists so they can concentrate on the stronger horses they have running in the race.”

To view the whole interview between Monty Kersten and Alan click here

Where does Happiness Come From? | Richard Del Monte

About Richard Del Monte Richard is a CERTIFIED FINANCIAL PLANNER™, Certified Wealth Consultant, and nationally recognized expert on Families and Wealth. Richard has been featured on FOX Business News, The Wall Street Journal, New York Times, Private Opportunities Club, Private Wealth Magazine, Trust & Estates, and Family Wealth Report. A sought after speaker, he…

The Future of Health Care | McKay Thomas

About McKay Thomas Since he was in high school, McKay Thomas has been an entrepreneur. Some of his companies have been, pooltables.com, baby.com and ainda.com Currently he is the co-founder and CEO of First Opinion, a company which matches a personal doctor to to their clients that they can contact 24 hours a day.…

Attention Triggers | Ben Parr

About Ben Parr Ben Parr is an award-winning journalist, author, entrepreneur, investor and expert on attention. Through his unique experience as a leading technology writer, venture capitalist and prolific public speaker, Parr has coached dozens of young startups and Fortune 500 corporations on how to get attention for their products. He was named one…

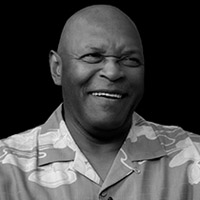

Beyond Baseball | Vida Blue

About Vida Blue Six time All Star, 3 time world series champion, MVP and Cy Young Award winner Vida Blue is quite a Baseball legend. Listen to his first hand experiences of what it’s like to play professional baseball and what’s the legend doing today? Interview Transcript: Alan Welcome back. I’m here today…