Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio

Have you been worried about the stock market’s recent volatility? You’re not alone.

The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling queasy. As long as you have developed a diversified portfolio, you can ride out many a bumpy ride.

A simple concept

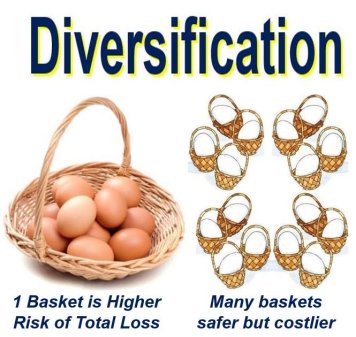

Diversification is a fundamental investment concept that most investors have no trouble understanding. If, for example, an investor owns equal dollar amounts of only two stocks, and one suffers a 50% loss, his or her portfolio has gone down in value by 25%. But if the investor owns ten stocks, and one drops by 50%, his or her portfolio has suffered only a 5% loss.

With a diversified stock portfolio, the risk is reduced because different stocks rise and fall independently of each other. On a broader scale, combinations of different investment assets may well cancel out each other’s fluctuations in price, reducing the overall risk.

Categorizing risk

The ultimate goal of diversification reduces systematic risk while reducing risk. One way to categorize risk is to distinguish between unsystematic risk and systematic risk.

how to reduce the unsystematic risk that is specific to a company. Often, this risk involves some kind of dramatic events such as a strike, a fire or some natural disaster. A company’s slumping sales also fall within this category. Diversification among the stocks of many companies reduces unsystematic risk because, of course, it’s highly unlikely that every one of the unhappy events listed above will occur in all companies.

Conversely, some events can affect all companies at the same time. This systematic risk includes such occurrences as inflation, war, and fluctuating interest rates—generally, those events that influence the entire economy. Of course, diversification cannot eliminate the likelihood of these events happening. Systematic risk accounts for most of the risk in a diversified portfolio. However, in exchange for enduring systematic risk, investors may be rewarded in terms of their investment return. There is no reward for taking on unneeded or unsystematic risk.

A diversified stock portfolio: how much?

One way that academic researchers measure investment risk is by looking at stock price volatility. A classic 1968 study by J.L. Evans and S.H. Archer, “Diversification and the Reduction of Dispersion,” concluded that an investor who owned 15 randomly chosen stocks would have a portfolio no more risky than the market as a whole. This research confirmed earlier advice, coming from instinct and experience, that Benjamin Graham gave to investors in his 1949 book, The Intelligent Investor. Graham recommended owning from ten to 30 stocks to achieve proper diversification.

A study published in 2001 (“Have Individual Stocks Become More Volatile?” by John Campbell, Martin Lettau, Burton Malkiel, and Yexiao Xu) suggests that those numbers may be too small. To replicate the risk of the market as a whole, according to the study, the “excess standard deviation” of portfolio returns needs to be brought down to 5%. In the 20 years ending in 1985, an investor could have achieved this goal by owning 20 stocks. But, in the period from 1986 through 1997, the professors concluded that one needed to own 50 stocks to reach the same result!

Choices in diversification

Of course, an investor who invests in income will diversify his or her holdings among different bonds. In this case how diversification reduces risk usually means owing long-, intermediate- and short-term government bonds. Other categories might include when appropriate, municipal, corporate and, sometimes, high-yield (“junk”) bonds.

For some investors, the goal of diversification within an asset class can be achieved relatively easily by purchasing shares in a mutual fund, which, by definition, offers automatic diversification.

It is possible for an entire asset class to do poorly for an extended period of time (as we have seen in recent years). Therefore, it’s a common diversification and risk reduction strategy for investors to spread their money across asset classes—including, for example, stocks, bonds, money market funds and real estate—in their portfolios.

Finally, some investors may want to think in global terms. By investing outside of the U.S., investors are addressing the risk of extended bear markets at home. Global investing includes additional risks, however, such as currency fluctuations and political uncertainty.

We hope you found this article about “Reducing Risk With a Diversified Portfolio” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

NBA All-Star Weekend Economic Influence

Written by Ryan Hickman. If you have walked around downtown Salt Lake City recently, you’d come across ginormous signs advertising the NBA. But not just advertisements for the local Utah Jazz, but for the annual pinnacle of NBA events: the 2023 All-Star Game. This annual event envelopes whichever city hosts the events, which include a…

Richard Rossi, Founder of daVinci50: The Man Behind The Amazing Age Reversal Revolution

Watch Richard Rossi’s recent interview with Alan Olsen about age reversal at: https://groco.com/featured-guests/mastering-age-reversal/ Richard Rossi is a revolutionary figure in the field of age reversal, with his company daVinci50 leading the way in exploring new treatments to combat aging. His research into stem cells and gene therapy has opened up exciting possibilities for reversing the…

Mastering Age Reversal with Richard Rossi

Introduction, in this interview, Alan Olsen, CPA, MBA discusses age reversal and AI with Richard Rossi, Founder, daVinci50. Transcript (software generated): Richard Rossi And I don’t know if you remember the day, chat GPT first came on your radar. For me, it was my birthday, the 13th of January of this year. And I’ve never…

Ken Neumann Unlocking Optimal Nutrition Strategies for Health and Well-Being, Founder and CEO of Youtopia

See Ken Neumann‘s recent interview with Alan Olsen about nutrition and Youtopia: https://youtu.be/wJF155EiM8I As a Nutritionist, Ken is a renowned expert in the field of health and nutrition, having spent years researching and developing innovative strategies for optimal nutrition. As founder and Chief Executive Officer of Youtopia, he has dedicated his life to helping people…