When Good Fortune Comes Your Way

When Good Fortune Comes Your Way

Whether expected or not, an inheritance, divorce settlement, severance package or pension payout, proceeds from the sale of a business, life insurance, legal judgments, or even lottery winnings—all can put in your hands the equivalent of several years of earnings. Now you’re at a crossroads—suddenly called upon to switch from wealth-building mode to wealth management. You will, of course, face circumstances special to your situation. Yet, there are some general guidelines that apply to almost all such transitions.

Proceed cautiously

Financial windfalls often come with an emotional price tag: the loss of a loved one, a serious injury. Or it can mean a major change in your life—ending a career or selling a business. Even for a lottery winner, euphoria may make long-term planning a challenge. Fortunately, in most situations, major decisions are not required immediately. Cash can be set aside in the money market, in short-term CDs or in an interest-bearing bank account. Although rates are not very impressive these days, at least you won’t lose money while you regroup.

Similarly, retirement plan assets can be left in place for a reasonable period of time. An inherited IRA, for example, gives the beneficiary until December 31 of the year following the death of the owner to decide between cashing in immediately, or within a five-year period, or over his or her life expectancy.

Whatever the case, give yourself some time to regain your emotional bearings and to think about what uses of your new wealth will give you the most satisfaction.

Where are you headed?

Is your sudden wealth large enough that you can retire? If that course is attractive to you, you should think of your assets—new and old—not as a lump sum but in terms of the after-tax annual income that they can produce over the course of your life. Is that figure enough to support the lifestyle that you envision for yourself and your family? Or, if you will continue in your present position, do you simply want to clear debts, ensure your children’s education, invest for your eventual retirement and provide for those whom you leave behind?

Among your goals should be a review and update of your estate plan, so as to include your increased assets. You also will want to consider a revocable living trust and/or a durable power of attorney to provide for the management of your assets in the event of incapacity.

The issue of taxation

If your new wealth is taxable, it will be taxable as ordinary income when it comes from lottery winnings, royalties, severance payments, mineral rights and the like. Legal judgments are taxable, except to the extent that they are compensation for physical injury.

If the money comes from the sale of a business, it may be subject to tax on any capital gains realized. Proceeds from the sale of your home also are subject to capital gains tax, but the first $500,000 in gains may be exempt for a married couple ($250,000 for a single individual). Retirement plan payouts are taxable and may be subject to a penalty tax as well if you aren’t age 59 1/2. However, the tax may be deferred when rolled over into an IRA. Most inherited assets are received with a stepped-up basis and, thus, are subject to little or no tax if sold.

Taxes can be a major complicating factor to new wealth. The services of an experienced tax advisor may help you uncover ways to minimize their impact and are well worth investigating.

—————————————————————————————————————————————————————————————————————

We hope you found this article about “When Good Fortune Comes Your Way” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Unveiling Entrepreneurial Success with Randi Brill

Randi Brill, best-selling author and CCO of Just Call Randi Design Agency discusses unveiling entrepreneurial success on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Randy brill. Ready welcome to today’s show. Randi Brill Thank you, Alan. I’m glad to be here. …

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

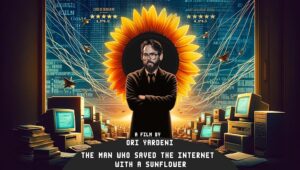

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…