Gift Tax: Tips from the IRS

Gift Tax: Tips from the IRS

Taxpayers who have given gifts exceeding $11,000 in value to a single individual must report the total gift amount to the Internal Revenue Service (IRS). The giver may owe taxes on the gifts. The recipient, however, does not have to report or pay taxes on the value of the gift. Individuals who need to file a gift tax return should use Form 709:United States Gift (and Generation-Skipping Transfer) Tax Return.

Gifts include money and property. If someone uses property and the owner of the property doesn’t expect to receive something of equal value in return, that is also a gift. Selling something for less than the market value of making an interest-free or reduced-interest loan may also be gifted.

Tuition or medical expenses paid directly to an educational or medical institution, however, are not gifts. Gifts to spouses who are U.S. citizens, charities, and political organizations do not count against the annual limit, either.

The limit for gifts given to spouses who are not U.S. citizens has been increased to $117,000 this year.

More Gift Tax Changes

Other changes occurring this year affecting gift taxes include: filing Form 8892, Application for Automatic Extension of Time to File Form 709 and/or Payment of Gift/Generation-Skipping Transfer Tax. Predeceased parent rules used to determine an individual’s generation assignments for certain transfers occurring on or after July 18, 2005, have been amended.

The lifetime exemption for generation-skipping transfers (GST) remains $1.5 million.

Tax preparers should also be aware that husbands and wives cannot file a joint income tax return. Community property given as a gift is considered to be two gifts, each representing half the value of the property, given by both individuals.

Finally, only individuals are required to file gift tax returns. Individual beneficiaries, partners and stockholders may be liable for GST if their portion of a gift given by a trust, estate, partnership or corporation exceeds the $11,000 value limit.

We hope you found this article about “Gift Tax: Tips from the IRS” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

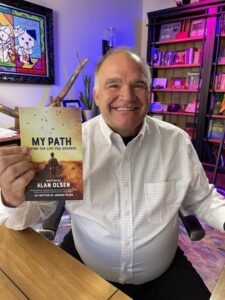

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

[vc_row][vc_column][vc_column_text]

[/vc_column_text][/vc_column][/vc_row]

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…