Keeping Harmony and Wealth Within the Family Upon Your Death

Keeping Harmony and Wealth Within the Family Upon Your Death

Keeping harmony and wealth within the family upon your death is often a tricky thing, as illustrated in this account. “You’ll hear from my lawyer, Jason!” Mr. Stevens yelled at his nephew as he stormed out of the room. Such is how a family Thanksgiving dinner abruptly ended in the film, The Ultimate Gift[1]. This scene portrays a harsh reality of how families can tragically tear each other apart when it comes to wealth transitioning from one generation to the next.

Keeping harmony and wealth within the family isn’t as easy as one might think; “Seventy percent of estate plans fail because no one helps the next generation prepare to receive wealth[2],” says Richard Del Monte, President of the Del Monte Group. While addressing the topic of transitioning wealth may make some people feel uncomfortable, planning for the passing of a loved one is critical for things to run smoothly for the rest of the family. Here are several tips to start with.

Get Wealth and Your Death Out in the Open

Don’t be afraid to talk to your family about how you would like things to go upon your death… I still have vivid images of standing in a funeral showroom basement with my father as he took his dad shopping for a burial casket. Death is a very emotional time for families and even the smallest difference in opinion regarding how to honor mom or dad can spiral out of control. Purchasing a casket and burial plot before death avoids conflict in this area because you’re letting your family members know exactly what you want and how much you want to spend.

Gather the Family Together

Gathering your children for a family meeting to explain the inheritance process is also vital in maintaining harmony in the family. Keeping everything transparent and being upfront will allow you to convey your wishes in person, as well as address vagaries and questions. Speaking to everyone at once, and even recording the meeting, will help your children to clearly understand your wishes and shows that you care about each one of them. You can also take advantage of this time to explain what you value most in life, as well as whom they should look to for financial advice after you are gone.

Distribute Your Wealth Evenly

An inheritance can be viewed as a parting gift from the grave and even as an expression of love from parent to child. However, if one individual receives more than another, feelings among posterity could be hurt and relationships can be severely damaged. My recommendation is to distribute your wealth equally between your heirs to help maintain a sense of fairness, civility, mutual respect and being loved.

Trinkets and other heirlooms should probably be gifted before death, and a discussion about how you’d like to distribute non-liquid assets, such as real estate and collectibles, should be had with your posterity well in advance.

Should You Consider an Incentive Trust?

“Sometimes parents establish ‘incentive trusts,’ which may match or double the income a child receives from his or her salary. The trust agreement may provide that trust funds will be paid to a child only if he or she achieves a particular objective, such as obtaining a college or professional degree or holding a job for a certain number of years.”[3] One option you may want to consider with incentive trusts is paying for annual family reunions to ensure that your posterity will have the necessary funds to meet together for years after you pass.

Please note, if you desire to set up an incentive trust, be cautious and mindful of the feelings of your children. Trying to incentivize their behavior may create feelings of resentment as they may feel that you are trying to control their behavior with money, thus working against your goal of harmony in the family.

We hope you found this article about keeping harmony within the family after your death helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

[1] Sajbel, Michael O. & Landon, Michael Jr, directors. The Ultimate Gift. Fox Faith, 2006

[2] GROCO CPAS & Advisors. “Richard Del Monte – Transitioning Wealth.” Youtube, https://youtu.be/RWq7nciPBe0 . Accessed 24 August 2020.

[3] https://groco.com/readingroom/estate-trustschildren/

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

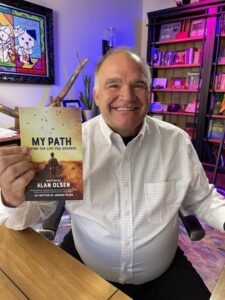

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…