Small Business Stocks Can Lead to Big Gains

What’s your investment strategy? There is no end to the number of different strategies that investors have, and there are plenty of different successful ways to invest in the stock market. Likewise, Wall Street is full of stories of investors that have ended up on the side of the road, kicked to the curb after their investments went wrong.

A lot of people like to invest in large, well-known companies that have a strong track record on Wall Street. These companies provide some security in investing, especially if you’re in it over the long haul. Companies, like Apple, Nike, Disney and Amazon might be very expensive, but investors will usually end up on the positive side of the market. However, those who invest in big name companies and choose to ignore the small companies could be missing out on some great returns.

It’s true that investing in small companies is a risk and it’s not for everyone, but the long-term gains can be substantial, especially when you hit one of those small companies that unexpectedly turn big. Additionally, investing in small companies might not be as risky at one might think. According to a survey from Hiscox USA, nearly three-fourths, 72 percent, of all small businesses questioned in the survey reported growth in revenue over the last year.

So, while the gains might not be as high as they are with many larger, more established companies, chances are most of your small business investments will give you a good return. Thus small businesses do represent a solid opportunity that most investors should not be overlooking.

2X Wealth Group: Investment Management Catered to Women | Lori Zager

“2X Wealth Group: Investment Management Catered to Women”, Lori Zager Transcript, Interview by Alan Olsen, Host of The American Dreams Show: Alan Olsen: Welcome back. I’m here today with Lori Zager. She is the co founder of the 2X Wealth Group which is a subsidiary of Ingalls & Snyder. Lori, welcome to today’s show. …

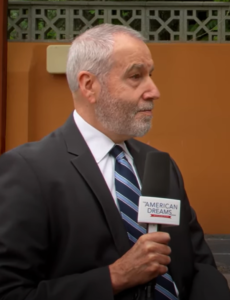

John Hoffmire

Transcript of John Hoffmire: Alan Olsen: One of the areas that you’ve been involved with is impact investing, what is impact investing? John Hoffmire: Well, impact investing can be defined as a number of different ways. I’m going to define it in the broadest possible way, where investments of almost all types make an…

Add These Leadership Skills for 2021

As we begin to exit the pandemic, are you looking to grow or enhance your leadership skills this year? If so, it is vital to have a plan as no one can expect to become a better leader just by showing up every day. Here are some important things to focus on in 2021. These leadership…

Workplace Accountability in Four Steps

Have you encountered a co-worker, boss or employee, who slacks off, unloads their work onto others, or takes credit for work and ideas that are not their own? Accountability in the workplace can often seem a bit too scarce, especially when the competitive drive kicks in. Or perhaps, someone that works hard, but never seems…