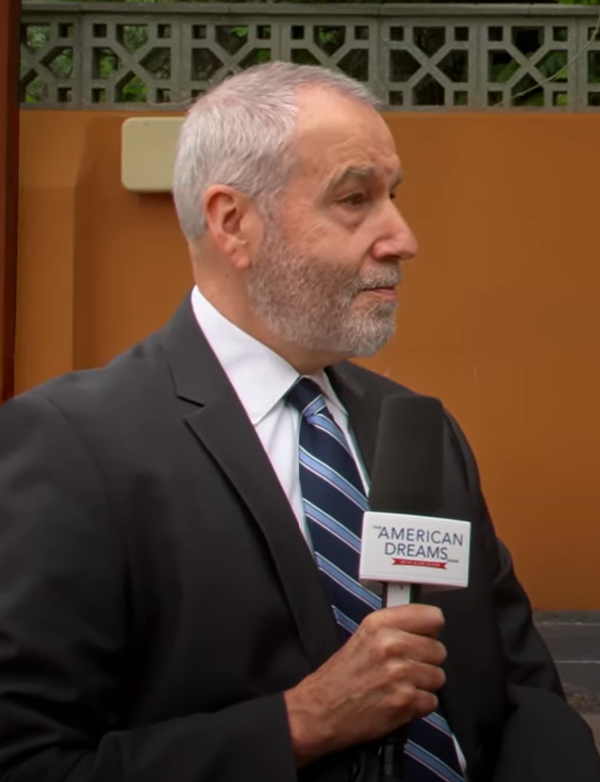

John Hoffmire

Transcript of John Hoffmire:

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

This transcript was generated by software and may not accurately reflect exactly what was said.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

About John Hoffmire:

John’s achievements in both the academic and business worlds are extensive and – having participated in work, research and speaking tours in 99 countries – John is regarded as one of the leading experts in his field. His pioneering approach has led to achievements such as: leading the first sale of shares for a microfinance bank to an Employee Stock Ownership Plan at K-REP in Kenya.

John is chairman of Cadence Innova, a change management consulting firm based in London. Before joining Saïd Business School at University of Oxford and becoming the Director of the Centre on Business and Poverty at the University of Wisconsin-Madison, John had a twenty-year career in equity investing, venture capital, consulting and investment banking. His work has had a particular focus on Employee Stock Ownership Plans. As founder and CEO of his own investment-banking firm, he helped employees buy and manage approximately $2.2 billion worth of ESOP stock. He sold his firm to American Capital, which then went public. John left American Capital as Senior Investment Officer when the company reached $1 billion in assets. After leaving American Capital, John was Vice President at Ampersand Ventures, formerly Paine Webber’s private equity group. Earlier in his career, after he finished his Ph.D. at Stanford University, he was a consultant at Bain & Company.

BioSource: http://www.kellogg.ox.ac.uk

Alan is managing partner at Greenstein, Rogoff, Olsen & Co., LLP, (GROCO) and is a respected leader in his field. He is also the radio show host to American Dreams. Alan’s CPA firm resides in the San Francisco Bay Area and serves some of the most influential Venture Capitalist in the world. GROCO’s affluent CPA core competency is advising High Net Worth individual clients in tax and financial strategies. Alan is a current member of the Stanford Institute for Economic Policy Research (S.I.E.P.R.) SIEPR’s goal is to improve long-term economic policy. Alan has more than 25 years of experience in public accounting and develops innovative financial strategies for business enterprises. Alan also serves on President Kim Clark’s BYU-Idaho Advancement council. (President Clark lead the Harvard Business School programs for 30 years prior to joining BYU-idaho. As a specialist in income tax, Alan frequently lectures and writes articles about tax issues for professional organizations and community groups. He also teaches accounting as a member of the adjunct faculty at Ohlone College.