Stock Dividends or Buybacks?

Stock Dividends or Buybacks?

Anyone who invests in the stock market wants to make money. Of course, the most traditional way to do this is buying a stock low and selling it after it increases in value: a capital gain. However, investors can, and do, make money from their investments in other ways, including buybacks and dividends. Anyone who invests in the stock market needs to understand his or her options when it comes to buybacks and dividends, including how these two options work and their differences.

Important Differences to Understand

While some investors might be under the impression that these are essentially the same thing, the fact is there are some important differences between the two.

Dividend – According the definition from The Economic Times, a “dividend refers to a reward that a company gives to its shareholders. Dividends can be issued in various forms, such as cash payment, stocks or any other form.” Its board of directors decides a company’s dividend and it requires the shareholders’ approval.

Buyback – Meantime, Investopedia defines a buyback this way; “A buyback is the purchase by a company of its outstanding shares that reduces the number of its shares on the open market.”

Investors Enjoy Dividends

In reality, almost all investors enjoy receiving a dividend. However, not all companies pay them. Typically, a new company just starting out would prefer to take its gains and put them back into the company. Older, more established companies are more likely to pay a dividend. In any case, investors love to receive them. Not only does it put cash in their hands, but it can also serve to increase or preserve confidence in the company as a viable growth option going forward.

Buybacks Might Hurt More Than Help

Buybacks have become increasingly popular over the last decade and many investors consider them an excellent alternative to dividends. Companies complete buybacks for several reasons. One factor that companies like about buybacks is that shareholders do not have a vote in the matter. Only corporate executives determine buybacks and many believe these are the people that benefit the most. Another reason companies complete buybacks is to save themselves when they are going to miss earnings. This can give a false outlook and make things look better than they really are.

The Downside to Buybacks

Companies also tend to fund Buybacks with debt and not with increased earnings. Thus, buybacks often hurt a company in the long run. The company goes into debt in order to make the earnings report or share price look better, but shareholders lose their shares without any say.

Dividends Offer Many Benefits

On the other hand, a dividend is often a sign of quality and growth in the company offering it. They are also typically paid with earnings and not with debt. Thus, when a company is making regular dividend payments that usually indicates it has consistent and regular cash flow. It’s also a positive sign of the stock’s overall quality and future growth. Additionally, shareholders not only get cash in hand, but they also keep their shares. Lastly, companies that pay dividends also tend to be the most stable when the market is down and the strongest when the market is on the rise. Thus, although they might seem similar on the surface, dividends appear to be much more useful and reliable than buybacks.

We hope you found this article about “Stock Dividends or Buybacks?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

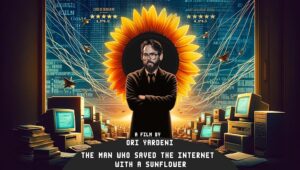

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…

Early Detection Saves Lives with Steve Marler

Steve Marler, Founder of Advanced Longevity discusses how early detection can save lives and overcoming a broken healthcare system on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to American Dreams. My guest today is Steve Marler. Steve, welcome to the show. Steve Marler Thank you. It’s great to be here. Alan Olsen So Steve,…