Time to Add These Watches to Your Collection?

Time to Add These Watches to Your Collection?

Rolex, Audemars Piguet, Tag Heuer, Vacheron Constantin, and Cartier, these are just a few of the most well known high-end luxury watch brands in the world. Owning a few expensive luxury watches is common amongst most high net worth individuals, but for some collecting multiple rare and/or high-end watches is a hobby or even an investment. According to one expert collector if you’re in to watches there are a few must-have timepieces that should be a part of your collection. His recommendations include, among others:

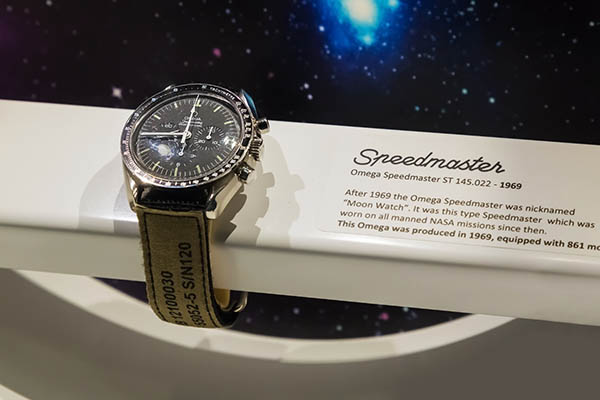

• Omega Speedmaster

• Rolex Submariner

• Jaeger-LeCoultre Reverso

• Casio G-Shock

• Breguet Type XXI

Investing in Collector Watches

Of course, at GROCO, we do not watch experts and we wouldn’t even attempt to give you advice when it comes to watch collecting. However, we can help you out when it comes to some of the dos and don’ts of collecting watches and other expensive collector’s items, especially the tax implications. Like any kind of collector’s item, the tax implications will depend on how and why you collect and what you end up doing with your collection. Like with any collectible, you must pay taxes on your gains and these gains to fall under the capital gains tax rate. Over the past few decades rare, vintage and high-end watches have seen a big increase in value as more wealthy individuals are putting more of their income into collectibles. Watches have been selling in increasing numbers recently at auction houses all over the world, and for higher prices.

Other Things to Consider

There are some risks to collecting watches, just as there are with any type of collectible. One of the most common risks is ending up with a fake, or with bad advice that a watch will increase in value when in reality it probably won’t. One important thing to always keep in mind, according to one collector is to stick with the big names. You can rarely go wrong with the likes of Rolex, Cartier and Patek. It’s very wise to use an expert when purchasing watches and going through an auction or trade show is also the safest route to go. You should also be aware that not all watches hold their value and when it comes to collecting watches used models are typically more valuable for collectors than new ones.

Appreciation Takes Time

While collecting watches can be lucrative, most watches will not end up with a huge return on your investment. You should also be aware that it takes a lot of time, usually 10 to 20 years, for a watch to start to appreciate in value, so you have to be prepared to be in it for the long haul. However, most collectors will tell you that the real reason you should buy a watch is for your enjoyment of the watch and not for investment purposes. To learn more about the tax implications of collecting watches or other types of collectibles please contact us today.

We hope you found this article about “Time to Add These Watches to Your Collection?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Strategies for Representing Yourself in an IRS Audit

Strategies for Representing Yourself in an IRS Audit Have you been selected by the IRS for an audit? It’s OK. Relax; you can get through this. Although we advise you to never try to go through an audit by yourself, if you really like a challenge and would rather do it by yourself, there are…

U.S. Government Could Lose Billions Due to Fewer Audits

U.S. Government Could Lose Billions Due to Fewer Audits Taxpayers rejoice! There may actually be some good news about tax returns this year. The US Government could lose billions due to fewer audits. That’s because according to reports, due to reduced staff, the IRS may be forced to reduce the number of audits it would…

- « Previous

- 1

- …

- 473

- 474

- 475