Top 10 Most Expensive Pieces of Art Sold in 2016

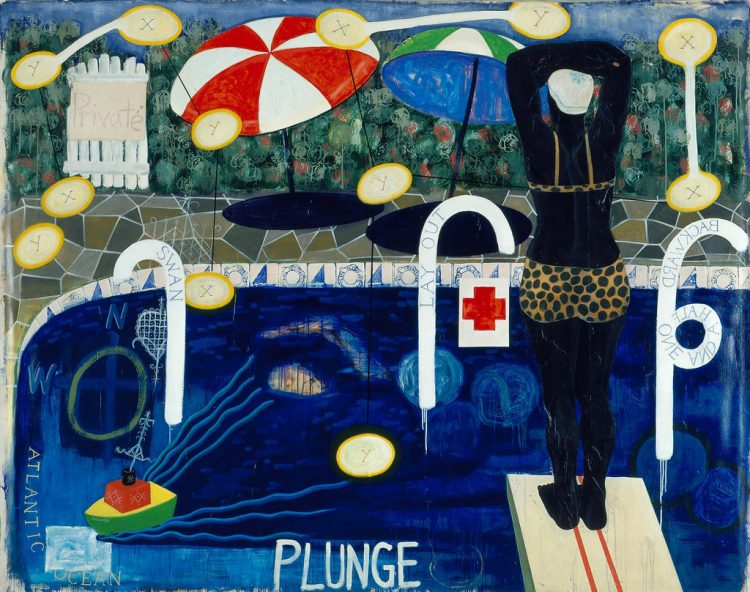

No. 10 – Kerry James Marshall- Plunge (1992) – $2.1 million

Plunge by Kerry James Marshall kicks off the list. This acrylic and paper collage on canvas is symbolic of the slave trade era. It garnered just north of $2 million at Christie’s.

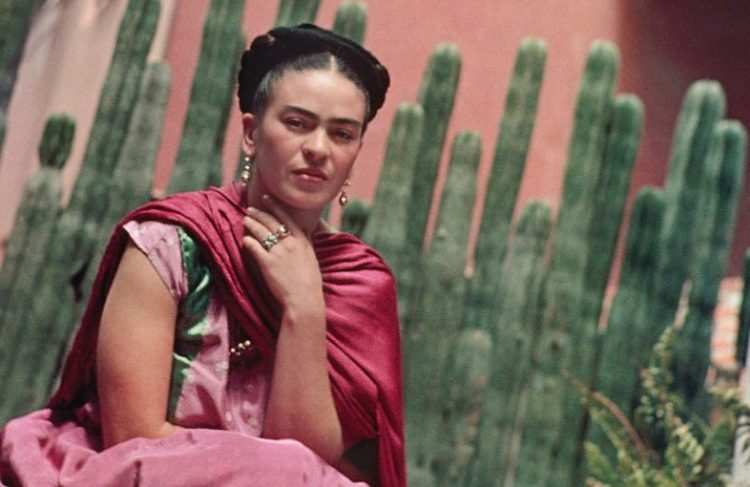

No. 9 – Frida Kahlo – Two Nudes In A Forest (1939) – $8 million

This piece has seen a huge increase in value over the past two decades as twentieth century female artists have grown in popularity. While it once sold for $150,000 in 1989, this painting just fetched $8 million in 2016.

No. 8 – Richard Prince – Runaway Nurse (2006) – $9.7 million

This painting sold for just $6.8 million five years ago, but it has increased in value by nearly $3 million over that time period. Purchased for $9.7 million in 2016 by Yusaku Maezawa, this contemporary piece from 2006 is part of Richard Prince’s “Nurse” series and has earned a lot of attention from both those in and outside of the art world.

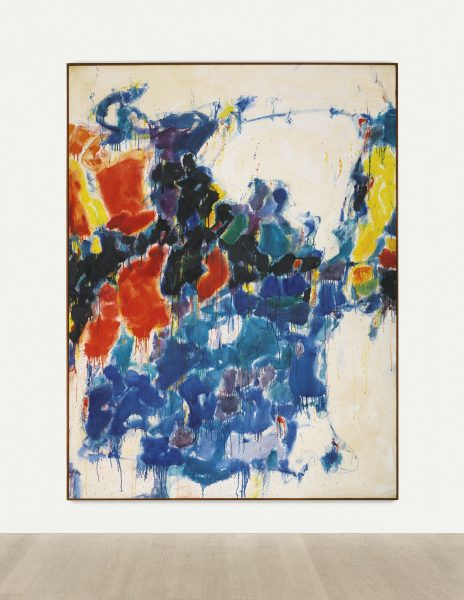

No. 7 – Sam Francis – Summer #1 (1957) – $10.4 million

Sam Francis has seen several of his pieces increase in value in the last few years, including this postwar/contemporary piece from 1957.

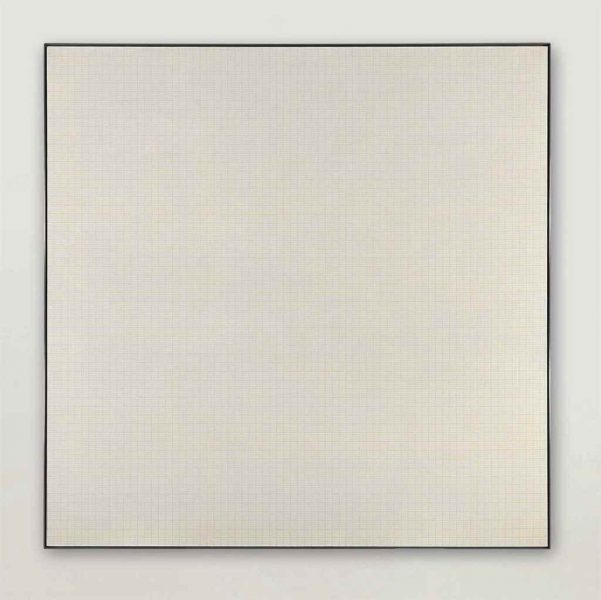

No. 6 – Agnes Martin – Orange Grove (1965) – $10.7 million

Perhaps the buyer of this painting loves oranges. It was expected to garner about $6-$8 million at auction but ended up fetching close to $11 million.

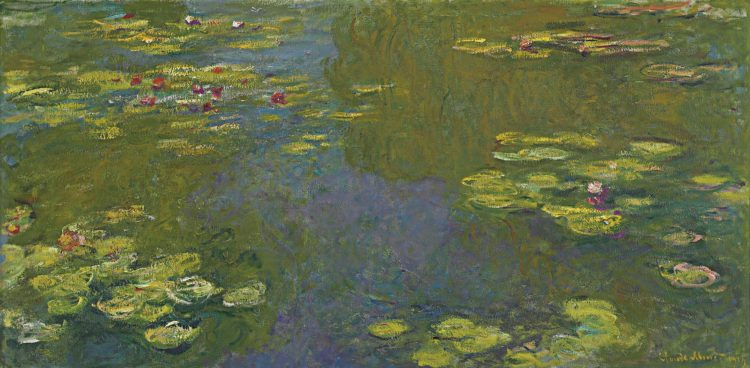

No. 5 – Claude Monet – Le bassin aux nympheas (1919) – $27 million

While most of Monet’s pieces are actually housed in museums, this one went on the block this year and fetched $27 million at auction.

No. 4 – Mark Rothko – No. 17 (1957) – $32.6 million

Coming in at number four is this symbolic postwar piece by Mark Rothko, which sold for more than $32 million at Christie’s earlier this year.

No. 3 – Jean-Michel Basquiat – Untitled (1982) – $57.2 million

This contemporary piece from 1982 is one of the top attractions in the neo- expressionist art genre, and it continues to increase in value. Twelve years ago it sold for just $4.5 million. But just like Runaway Nurse, it was purchased by Yusaku Maezawa for more than $57 million.

No. 2 – Peter Paul Rubens – Lot and His Daughters (1613-14) – $58 million

This is the second most expensive Rubens painting ever, trailing only his “Master of the Innocents.” This is an extremely old painting as well as extremely valuable.

No. 1 – Pablo Picasso – Femme Assise (1909) – $63.4 million

Picasso is not for everyone, but there’s no doubt his paintings have fetched some of the highest amounts of money in the world, including in 2016, which saw his Femme Assise sale for just over $63 million. Much of the value comes from this painting being credited with introducing a new form of art. And of course, it’s a Picasso.

You also might like the article Art as an Investment

Follow GROCO on Facebook

Business Angels for Your Startup Business

Business Angels for Your Startup Business By Mike Cain Setting up a new business can be a daunting prospect. There’s the possibility of failure, and with it, the risk of losing the money you’ve invested in your company, as well as seeing all your months or even years of hard work go to waste. But,…

Securing Second- and Third-Round Venture Capital Financing

Securing Second- and Third-Round Venture Capital Financing By Jim D. Ray Widget sales are booming – the competition is scrambling, demand is up, and the books are finally treading water. Your core management team has big ideas for the future of Widget Inc. Opportunity is abundant; but how will you fund that next big leap?…

Ten Ways Start-ups Use Venture Leases And Loans To Generate Millions

Ten Ways Start-ups Use Venture Leases And Loans To Generate Millions By George A. Parker The rise of venture leasing and lending has created an opportunity for sophisticated entrepreneurs to gain a competitive advantage. Savvy entrepreneurs are using venture leases and loans to generate millions of dollars for shareholders by leveraging existing venture capital. They…

Avoiding AMT

Avoiding AMT More and more taxpayers are finding a hidden tax on their individual tax returns. The alternative minimum tax (AMT) attempts to ensure that high income individuals who benefit from the tax advantages of certain deductions and exemptions will pay at least a minimum amount of tax. This tax was originally designed to keep…