With Congress Now Back What Will it Mean for Taxes

With Congress Now Back What Will it Mean for Taxes

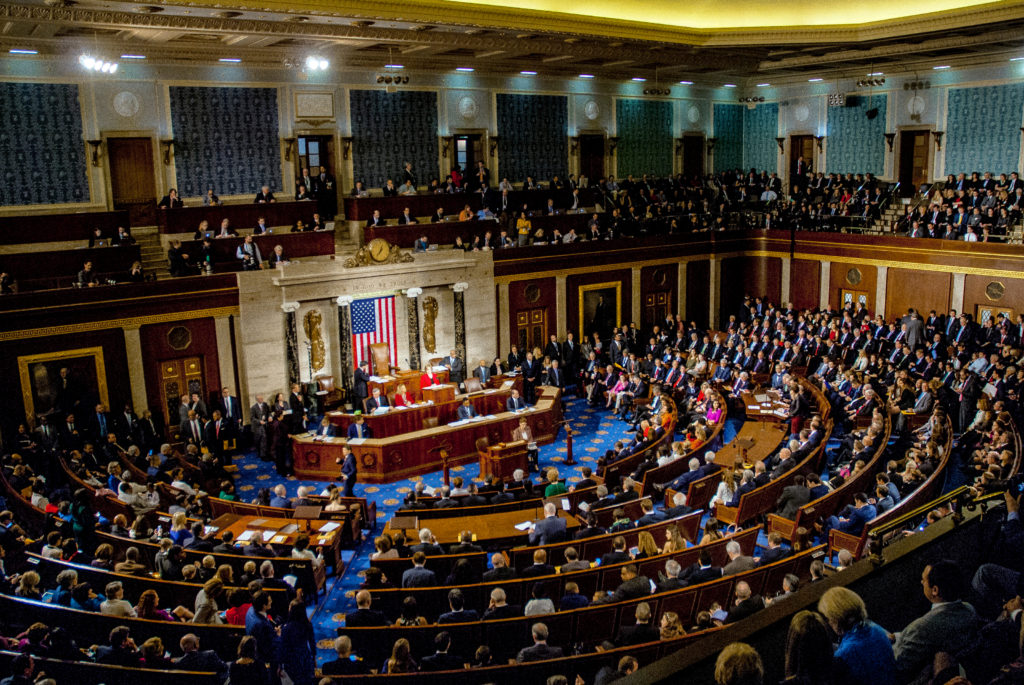

Fall is here and that means the rain and wind are on their way back. Congress is back as well and they have a lot to talk about. It’s not exactly clear how much they will get done in the next three months, but they do have several important pending issues that need to be resolved, including several items that will directly affect the upcoming tax season. Let’s take a look at some of the most important tax-related issues that Congress could be considering in the coming months as 2015 winds down.

Internal Tax Reform for Multinational Corporations

One of the largest tax issues that need attention is international tax reform. Republicans have made international tax reform a high priority but as often the case in Washington, both sides don’t always see eye-to-eye. While the White House has maintained that it would be open to the idea of international tax reform, there are several hurdles to overcome. Republicans want to change the tax code for large U.S. multinational companies with something called “innovation boxes,” which offer low tax rates on intellectual property. However, so far, the Senate does not seem too excited about the idea. Several issues would need to be hashed out, but the real issue might be that there simply isn’t enough time to get an agreement before the year ends.

Extend the Tax Credits

As it is almost every other year, whether or not to extend several tax breaks and credits is a big issue that needs to be resolved. Last year many of these break were extended for 2014, but not until the year was almost over. That left a lot of taxpayers in limbo, especially businesses and corporations. It is very likely that these credits will end up being extended yet again, but this time many of them might get a two-year extension. Likewise, they might just get them done a little sooner this time around.

IRS Getting Cut Again

Despite several issues caused by a lack of staff and resources earlier this year during tax season, it is likely that the IRS will again have its budget cut in 2015. That’s because Congress is expected to make more cuts this year and it’s unlikely that the white house or house democrats will try to stop that from happening. The highway trust fund is also expected to eventually pass which will include a multi-year transit and road package.

Latest Tax Plans From Presidential Candidates

Finally, expect a lot of action from both republican and democratic presidential candidates over the coming months in regards to their tax reform plans. From Donald trump to Jeb Bush and from Hilary Clinton to Bernie Sanders, there will be no shortage of rhetoric from the would-be presidential candidates throughout the next few months, and right on into next year. The presidential tax plans, along with all of these other important tax issues, will be taking place in what is likely to be a very hostile fiscal environment. No doubt it will be an eventful fall in Washington. Stay tuned.

—————————————————————————————————————————————————————————————————————

We hope you found this article about “With Congress Now Back What Will it Mean for Taxes” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Tips to Help Taxpayers with January 31 Tax Season Opening

We are again suggesting some tips to help taxpayers with the January 31 tax season opening. The IRS will begin processing most individual income tax returns on Jan. 31 after updating forms and completing programming and testing of its processing systems. The IRS anticipated many of the tax law changes made by Congress under the…

Looks Like More Wealthy Americans Are Saying Goodbye to the U.S.

The country just got done celebrating its independence this past weekend. With fireworks and all kinds of parties, Americans celebrated to show their appreciation for one of the greatest gifts they have: Freedom. Most Americans are very proud of their citizenship, even if they don’t always like everything the about the laws of the land.…

Why Are More Americans Kissing Their Country Goodbye?

Why Are More Americans Kissing Their Country Goodbye? As the controversy over tax inversions continues to rage on, there is another telling sign that more and more Americans are finding the country’ tax code too frustrating to handle. It’s not just U.S. companies that are giving up their U.S. citizenships, so-to-speak. An increasing number of…

European Union Going After Tax Deals in the Netherlands

European Union Going After Tax Deals in the Netherlands The list of international tax havens is long and each country has it’s own benefits. However, no matter which country people or businesses choose to partner with in an effort to save on their tax bill, that effort is getting harder every day. It seems that…