What Steps Lead to an Effective Estate Plan?

Do you have an estate plan? A lot of people don’t, for a lot of different reasons. Some people would rather not discuss their death under any circumstances, other people think they are too young to worry about an estate plan, while others just don’t know, or aren’t, sure where to begin. However, it’s a good idea for everyone to have an estate plan in place; and for those who already have one, it’s a good idea to review it often.

A good estate plan consists of several things, but every estate plan is a little different according to each individual’s circumstances. However, there are some aspects that are consistent with every effective estate plan. Let’s take a look at a few of them.

- Be sure you determine who will be in charge of your estate and your affairs should become unable to do so.

- It’s always a good idea to set things up to avoid probate both in this life and for your heirs when you die. Trusts can help you do this.

- Make sure to take care of your children, including children from a first marriage if you have divorced and remarried.

- Protect the assets that your heirs will inherit from lawsuits, divorces and high taxes.

- Be sure to leave provisions and assets for any children or grandchildren with special needs.

These are just a few of the important things to keep in mind when planning your estate. If you have more questions about estate planning, especially as it pertains to your taxes, then please contact GROCO today at 1-877-CPA-2006. We can help answer your questions and get you prepared for the future. Click here to learn more.

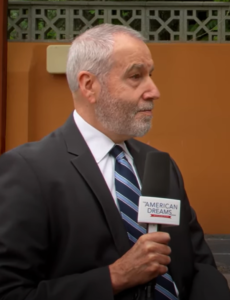

Allen Miner – SunBridge Group

Interview transcript of Allen Miner, SunBridge, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Welcome back and visiting here today with Allen Miner. He’s the CEO and founder of the Sunbridge group. Welcome to today’s show. Allen Miner: Great to be here. Alan Olsen: So Alan for the listeners, can you…

2X Wealth Group: Investment Management Catered to Women | Lori Zager

“2X Wealth Group: Investment Management Catered to Women”, Lori Zager Transcript, Interview by Alan Olsen, Host of The American Dreams Show: Alan Olsen: Welcome back. I’m here today with Lori Zager. She is the co founder of the 2X Wealth Group which is a subsidiary of Ingalls & Snyder. Lori, welcome to today’s show. …

John Hoffmire

Transcript of John Hoffmire: Alan Olsen: One of the areas that you’ve been involved with is impact investing, what is impact investing? John Hoffmire: Well, impact investing can be defined as a number of different ways. I’m going to define it in the broadest possible way, where investments of almost all types make an…

Add These Leadership Skills for 2021

As we begin to exit the pandemic, are you looking to grow or enhance your leadership skills this year? If so, it is vital to have a plan as no one can expect to become a better leader just by showing up every day. Here are some important things to focus on in 2021. These leadership…