IRS Blames Budget Cuts for Smaller Workforce, Poorer Customer Service

If you had any less than desirable experiences with the IRS this year then you’re probably not alone. That’s because the top tax agency continues to be plagued by complaints of poor customer service and a general lack of assistance. According to the IRS there’s good reason for that. The agency says it cannot keep up with taxpayers needs due to the continuing budget cuts it has experienced over the last several years.

Because the IRS has less money to work with they have had to reduce their workforce and many people’s calls simply go unanswered. The IRS also continues to get a bad report card when it comes to customer service, because the agency can’t spend as much time training employees and they have a harder time retaining the employees they would like to keep. It all adds up to a lot of unhappy taxpayers and very few signs of encouragement.

It appears that unless the IRS gets a budget boost the problems will not only persist but they will likely get worse. Over the past six years, tax rolls have jumped by seven million new filers. Because of the surge, simply hiring temporary workers to help during the busy season doesn’t work anymore. That leaves taxpayers confused, frustrated and angry. People who need special help seem to be hurt the worst by all of this.

While the IRS continues to claim it needs more money in order to fix the problems, many Republican lawmakers are hesitant to raise the agency’s budget until the nation’s tax code is overhauled and simplified. In other words, the IRS could be waiting for a long time before they see an increase in their budget.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

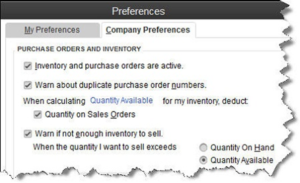

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…