04.29.20 President Trump’s Impact Payment letter & Foreign Pension Trusts

Rev. Proc. 2020-17 on Foreign Pension Trusts and summary from attorney Andrew Mitchell:

https://intltax.typepad.com/intltax_blog/2020/03/rev-proc-2020-17-exemption-from-filing-forms-3520-and-3520-a-for-applicable-tax-favored-foreign-trus.html

President Trump’s letter to taxpayers getting Impact Payments:

https://www.usatoday.com/story/news/politics/2020/04/28/coronavirus-trump-letter-stimulus-check-recipients-causes-stir/3040031001/

Info on IRS Form 7200 for Advance Payment of Employer Credits due to COVID-19:

https://www.irs.gov/forms-pubs/about-form-7200

Supplemental funds for Paycheck Protection Program plus new money for hospitals, coronavirus testing signed into law:

https://www2.deloitte.com/content/dam/Deloitte/us/Documents/Tax/us-tax-taxnewsandviews-200424.pdf

The Power of Investing With ESG | Peter Kellner

Interview Transcript of: The Power of Investing With ESG | Peter Kellner Alan Olsen: Can you tell us a little about your background? Peter Kellner: I got out of college in the early 90’s with a real passion for sustainability. I went to Budapest, Hungary on a scholarship. My family is actually from Budapest and…

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

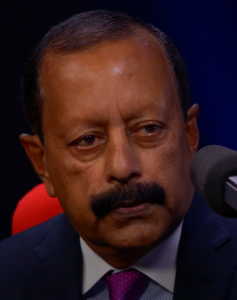

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…