2020 IRA Contributions Extended To May 17

In Today’s 2020 IRA Contributions Extended To May 17 Show:

1) Clarification: The deadline for IRA contributions for 2020 is also extended to May 17, 2021.

2) Just don’t forget those Q1 Estimated Tax Payments still due 4/15/2021; But Congress is asking the IRS to also extend this to May 17, 2021.

3) Key Senator says (D)s don’t have the votes to increase the U.S. Corporate Tax rate to 28%

4) California AB 80 is still unresolved – Shame, Shame, Shame.

5) Is the U.S. government in DEFAULT for not paying refunds??? Ask around.

6) Proposed changes to the International Tax Framework.

Greenstein, Rogoff, Olsen & Co., LLP

rcohen@groco.com

510-797-8661

www.groco.com

1) Deadline for IRA Deductions also Extended to May 17, 2021

https://www.taxpracticeadvisor.com/individual-income-taxes/news/21216368/deadline-for-ira-deductions-also-extended-to-may-17-2021

The IRS clarified Taxpayers may be able to claim a deduction on their tax return (2020 tax returns are due by May 17, 2021) for contributions to their Individual Retirement Arrangement (IRA) made through May 17, 2021. That is, they have beyond April 15, 2021 to make contributions for the 2020 tax year. There is no longer a maximum age for making IRA contributions. There are still income limitations and issues if you are covered by a retirement plan at work!!

2) Members of Congress request estimated tax deadline postponement (for the 2021, Q1 Estimated Tax Payment due April 15, 2021):

https://www.journalofaccountancy.com/news/2021/apr/member-of-congress-request-estimated-tax-deadline-postponement.html?utm_source=mnl:cpald&utm_medium=email&utm_campaign=02Apr2021

3) Joe Manchin Says Senate Democrats Do Not Have Votes to Raise Corporate Taxes to 28 Percent

https://www.breitbart.com/politics/2021/04/05/joe-manchin-says-senate-democrats-do-not-have-votes-to-raise-corporate-taxes-to-28-percent/

Sen. Joe Manchin (D-WV) conveyed Monday there are not enough votes in the Senate to pass President Joe Biden’s $2.25 trillion infrastructure proposal due to six or seven Democrats who oppose raising the corporate tax rate to 28 percent.

“Senator Joe Manchin just said Democrats do not have the votes to pass the American Jobs Plan in the U.S. Senate. Manchin says he knows of 6 or 7 Democrats who agree hiking the corporate tax rate to 28% would put the country’s competitiveness at risk,” according to a Fox Business reporter.

If Manchin’s vote count is accurate, it indicates Biden may have a tough time raising corporate taxes above the 25 percent rate … China charges American businesses. The United States’ current corporate tax rate, set by former President Trump, stands at 21 percent.”

You Decide whose right…I’m just telling you what they are saying….

3) California AB 80 is STILL unresolved for PPP related deductions. Shame, Shame, Shame….

4) https://www.journalofaccountancy.com/news/2021/apr/member-of-congress-request-estimated-tax-deadline-postponement.html?utm_source=mnl:cpald&utm_medium=email&utm_campaign=02Apr2021

Now: Going into Rocket Science…one of my favorite issues, International Tax

From Deloitte:

“Senator Wyden unveils international tax ‘framework”

https://dhub.blob.core.windows.net/dhub/Newsletters/Tax/2021/TNV/210405_1.html?elqTrackId=37561fc6eb2140589f12a22e007273ef&elq=1f967a2d5ebb4a309ce99a2600277d59&elqaid=83401&elqat=1&elqCampaignId=15521

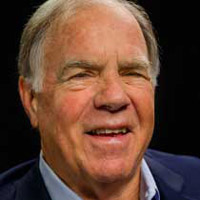

Ron Cohen,

CPA, Partner at Greenstein, Rogoff, Olsen & Co., LLP CPAs & Advisors

Email: rcohen@groco.com

510.797.8661

Click here to listen to more from Ron.

Click here, then scroll down, to see Ron’s bio.

To receive GROCO’s free newsletter, click here.

Click here to learn more about Greenstein, Rogoff, Olsen & Co., LLP (GROCO.com) Advisors to the ultra-affluent.

Demand Acceleration | Rajiv Parikh

About Rajiv Parikh Rajiv Parikh is the CEO of Position, an integrated digital marketing firm that drives brand visibility and new customer acquisition for technology-driven brands. Position² has operations in the US and Asia with clients from around the world. Their 200 person team combines advertising, marketing, product & technology expertise. The company is…

Building Communities and Balance In Life | John Dutra

About John Dutra John J. Dutra was appointed Chief Executive Officer in 2007. As CEO, he is committed to building on the company’s unrivaled reputation of partnering with local entities, political leaders, property owners and builders. John strongly believes in providing quality, personal integrity and a high level of service in all endeavors. From…

The Man Who Built Dreyer’s Grand Ice Cream | Gary Rogers

”You only get one trip around this track of life. There are no mulligans… let’s make it as good as it can be” – T. Gary Rogers About Gary Rogers T. Gary Rogers is the former Chairman of Safeway Inc., which he was instrumental in selling to Albertson’s in early 2015 for $10.4 billion. Previously…

The Art of Philanthropy | Tad Taube

Episode Transcript of: The Art of Philanthropy | Tad Taube Alan Welcome back and visiting here today with Tad Taube. And welcome to today’s show. Tad Thank you. Alan So, Tad you’ve done a lot throughout your life. But I want to focus a little bit on, on today more that philanthropic causes that…