The Man Who Built Dreyer’s Grand Ice Cream | Gary Rogers

”You only get one trip around this track of life. There are no mulligans… let’s make it as good as it can be” – T. Gary Rogers

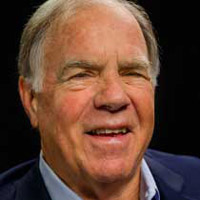

About Gary Rogers

T. Gary Rogers is the former Chairman of Safeway Inc., which he was instrumental in selling to Albertson’s in early 2015 for $10.4 billion. Previously he was the chairman and chief executive officer of Dreyer’s Grand Ice Cream, which he and his partner, William F. Cronk, built into the largest ice cream company in the United States and then sold to Nestle in 2006 for $3.2 billion. He has also been the chairman of Safeway, Levi Strauss, the San Francisco Federal Reserve Bank, and a director of a dozen other West Coast-based companies. He is a member of the Bay Area Business Hall of Fame.

Early in his career, Rogers worked for four years as an associate at the San Francisco office of McKinsey & Co.

Prior to acquiring Dreyer’s in 1977, he and Cronk founded and ran a limited menu restaurant company, Vintage House Restaurants, which failed.

Rogers graduated from the University of California Berkeley in 1964 where he earned a Bachelor of Science degree in Mechanical Engineering. A member of the varsity crew, he was named All University Athlete in 1963 and rowed in the U.S. Olympic Trials in 1964. He has been inducted into the Cal Athletic Hall of Fame. He obtained his MBA at Harvard Business School in 1968, graduating as a Baker Scholar (top 5% of his class).

Bio courtesy of Gary Rogers.

Interview Transcript of: The Man Who Built Dreyer’s Grand Ice Cream | Gary Rogers

Alan

Welcome back. I’m here today with Gary Rogers and Gary has been a longtime resident of the Bay Area and also has done many successful ventures probably most noted for dryers ice cream. And Gary, welcome to today’s show.

Gary

Thank you. It’s great to be here.

Alan

So Gary, for the for the listeners, can you give us your background and things that you’ve done to bring you up to today?

Gary

Okay, well, I was born in California. I grew up here. I grew up Marin County before it was Marin County is a very rural agricultural dairy area when I was growing up there. And, you know, went to public schools, wound up at the University of California as a engineering student. Graduated there, after a lot of different activities. wound up doing two years in the Army. And those days, we all had to do ROTC and you had a choice of either being drafted or getting your commission if you took four years of ROTC. So I did the latter, I found that to be a really good experience. Went on to the Harvard Business School, which was really a right turn for me, I certainly hadn’t expected it. But that too, was just an amazing experience. I was scared, stiff. Tell a quick little story here. A friend of mine had me as an usher in his wedding as Usher gifts, he had given me a silver cross pen, which I thought was a really cool deal. So when I went to Harvard Business School, of course, we all wear coats and ties, and I had my silver cross pen, and I was ready to take notes. Well, my first class, I looked at the right, gold, I looked to the left, gold, I looked up behind me in the central theater, classroom, gold, and I went home and I told my wife, you know, honey, we just start going to make it. This is not this is too much. But I survived. I actually wound up with the color Baker scholar and the top 5% of my class and went on to McKinsey and Company, which is kind of the place everybody wanted to work in those days, I think still is a great place for business school graduates, and then wound up founding a restaurant company of all things. And the short story there is we opened five restaurants and went broke. I think that’s that’s something every successful businessman ought to do. I really had to pick myself up off the ground with no money, I had four kids at home, all under the age of seven. I really didn’t want to go back to work for anybody else. Because I’d had the joy of having my own company even though we’d failed. And I wound up buying dryers ice cream with a million dollars of other people’s money. And we built dryers into the largest ice cream company in the United States, sold at Nestle for $3.2 billion. And that was 10 years ago, or actually 12 years ago, cuz I stayed on for two years and ran dryers for Nestle after they owned it. And then since then, I’ve done a wide variety of things that I’ve sat on many, many boards. You know, I was chairman of Levi Strauss for a number of a number of years I was chairman of Safeway for a number of years, I was chairman of the San Francisco Federal Reserve Bank for for you for two years. I was on the board for six. But interestingly, I was there in the financial crisis. So Janet Yellen was my president. I can say that the most powerful person in the world who I think the Fed chairman is, I think the most powerful person in the world work for me. It’s kind of fun. And I’m still young I think I’m on six boards currently three for profit boards and three more philanthropic boards. I’m very involved in the Oakland Community and have a wonderful family of four boys and 11 grandchildren and life is good. I’m about to be 75 and I can smile at sort of you know what’s happened is I’ve gone down the trail and I’ve still very much enjoying life.

Alan

It’s an amazing life and you and I just know here after all these great accomplishments you christened all this with your family and your and your grandkids and I think that gives us perspective in life doesn’t

Gary

The older you get the more you realize that’s really what it’s all about.

Alan

Gary, I want to I want to roll back and you know, spend a little bit of time going through your dryers experiencing and most people go to the grocery store, and they they see that brand every week and still a very prominent brand. However, I’m running up against a break right now. Okay, and so I’m visiting here today with Gary Rogers. He’s a longtime entrepreneur, resident of the San Francisco Bay Area, philanthropist, and after we come back from the break, we’ll talk about dryers. Great. We’ll be right back after these messages.

Alan

Welcome back and isn’t here today with Gary Rogers and Gary has been a longtime entrepreneur, philanthropist and resident of the Bay Area community and, and Gary, in the first segment we talked about one of the you had ventures before but one of the most notable ventures that you did was at a purchasing dryers ice cream in 1976. Company was founded in 2028. Right? So what did you do differently? Well, it was a relatively small regional company at that time. But how did you how did you take that from what it was to what it became?

Gary

Well, I think my answer is mostly about people. But we also did some things right? Strategically, when when I bought the company, the owner at that time, took me out behind the plant. And he showed me seven or eight beat up 20 year old ice cream trucks. And of course, my instincts as a Harvard Business School grad and McKinsey consultant, all that was, well, you know, we’ll sell the trucks. And I knew that all the big grocers operated ice cream warehouses and almost all the ice cream pistol through the warehouse, and that chain themselves would handle the distribution and the stocking to the store is not with me, that was my first idea to get this company on track. But this, this owner said to me, he said very simply said, Gary, whatever you do, don’t sell the trucks. And I just gone broke in the restaurant business. And so I thought maybe, maybe it wouldn’t be smart to take the primary advice that the former owner had given me and just ignore it right out of the blocks. So we started off with what they call direct store delivery. And that became our, probably our key strategic element. And what we found was that there were a lot of reasons why handling the ice cream yourself. Right to the cabinet. Just briefly, you know, these grocery employees are always overworked. The ice cream tends to sit in the aisle when they’re stocking it at two in the morning. Ours was a premium ice cream, you know what happens to ice cream melts before it gets back into the freezer. And then, by having a relationship with a store level people, our salesmen could gradually get more space. They could say well, Haagen Dazs didn’t fill their cabinet that their their shelf this today, let us fill it for you. Or, you know, there’s a little space down here that really isn’t used properly. And at store level, you could do a tremendous amount of selling. In the previous company they had called Ice Cream drivers, we called them ice cream salesman, it just that little change made a huge difference. And we turned we turned out to be the most overstocked ice cream, we had more shelf space, relative door sales than anybody else in the industry. And that proved to be a really key element or our strategy. And we also facilitate something called Scan based trading where instead of having the store clerk come out when we showed up with our truck and count the ice cream, as we brought her into the store and handle it invoice and all that sort of thing. We we were able to have the grocer incur his obligation to us that the ice cream wouldn’t be put in the store on a on a basis where it was still our ice cream. It wasn’t the store’s African ice cream was on consignment. And when the ice cream went over the scanner, the grocer incurred the obligation to us at the same time that he took money from his customer. And they really liked that. And they would pay us the following Monday for all the ice cream that had gone over their scanner the preceding week. Well, what that did in addition to being a much more efficient way of handling the the ice cream and the transaction to the store, it gave us the knowledge of what the store had sold, we always we always knew what it had bought from us. But now by knowing what it has sold, we knew by definition, exactly what the inventory was in the store at all times, day by day. And so we could route our trucks the way UPSs I mean, if a store didn’t service we just pass it by. And that made us much more efficient. But the really different thing we did is we developed a culture that was probably the biggest instalment in our success. And we were very careful who we hired, if you came to work for us, you’d probably go through six or seven really intensive interviews. And it was very hard to get on board. But once you were an employee, you were trusted you, if you came to work for us, we would give you a business card with your name on the front, and whatever your title was, you turn it over, it would say, company philosophy, use your own best judgment at all times. And we practice that we had something we called the upside down organization, which meant that as CEO, I was at the bottom of the pyramid was sharp, and it was digging into the ground. And that we had this philosophy that the people that really made for the success of the company were the people who made the ice cream that people who deliver the ice cream that people who sold the ice cream. And we tried to sort of invert the way the whole organization work so that the people who did the real work, got the credit. And that had huge transformative impact on the company. We also trust that our people beyond any company I’ve seen, I mean, we felt that the person who was on the front line, the person who had the responsibility for issue, will probably had a better perspective on it than anybody else in the company. So if you work for me, and you came to me with a suggestion, I would hear you out, I would give you my honest opinion of what I thought the pros and cons were. But at the end of that conversation, I would say, Alan, you decide. Now that seems like a fairly simple thing. But you know, having worked in companies, I know that the subordinate always expects the superior to make the decision at the end of a conversation like that. And if you think about that, if you’re a good employee, you’re a good soldier, you go off and you try to make that decision effective. But if it doesn’t work, you know, and you say to yourself, Well, Gary made the decision I didn’t. But if I say to you, you decide, it takes that all away, and now you’re responsible for the decision. You’re also responsible for the outcome. And so I’ve come to believe that you decided the two most powerful words in the English language. My wife, my kids are so tired of me say you decide when there’s a family decision to be made. But it is amazing, amazingly effective. So that’s just one example. I mean, we had a lot of other I give you a lot of other examples of the kinds of things we did, but our people were so loyal, and so committed and and they knew they were trusted, it was okay to fail. We encouraged failure was terribly powerful for us.

Alan

I’m busy here today with Gary Rogers. And Gary is most noted for his role at dryers ice cream. But Gary, you’ve done a lot of other things when I’m running up against the break. So after we get back, I want to talk about your exit from dryers or your sale to Nestle’s and then and then what you’ve done post dryers Okay, well, we’ll be right back after these messages.

Alan

Welcome back. I’m visiting here today with Gary Rogers. And Gary, we’re talking about your role at dryers. You know, acquiring the company with the partner 1976, building it into a name brand in the store and then eventually selling out in 2001. I’d like to spend a few minutes talking about what what led up to the exit and then post dryers. What did you go on to do?

Gary

Well, the story of of Nestle and dryers was a long one because we had just barely got acquired dryers. When the president of Nestle USA, the US a division of this huge at that time $60 billion food company gave me a call and he wanted to come see me. And from that day forward almost every month, until we finally sold them a piece of the company. He was there. See Nestle and Unilever were worldwide competitors in ice cream. If you added up all their ice cream businesses around the world, Unilever had just a slight lead on Nestle. And the acquisition of dryers even when it was small by Nestle would have put them in first place. That’s why these big companies work alright. And they I mean, they really were eager To acquire dryers. And they made a clear they were very fair, and they never were really tough. I mean, they, they just kept making the argument over and over and over again. And when the CEO of Nestle calls you, you got to answer. So finally, after I don’t know how many years, we agreed to sell Nestle 18% of dryers, it was part of my defensive strategy, because by selling them 18%, they agreed to a tenure standstill. So that meant that for 10 years, this pressure that I’d been under, to sell the rest of the company would go away. And did they honored that tenure contract. And I thought 10 years was a long, long time. I mean, for Nestle who thinks in centuries, 10 years was just, I mean, for them, it was a stakeholder position. For me, it was a defensive decision, right. But that 10 Years went by very quickly, when the nine year point came by, CEO of Nestle started to land on my couch again, and, and we wound up agreeing to an extraordinarily attractive offer for my shareholders. And you know, when you’re a public company, you’ve got to think in terms of what’s in the best interest of the shareholders. And so this company that we had acquired for $1,000,000.25 years before, we were able to sell for $3.2 billion. And the IRR was something like 42% for 25 years. So it was an extraordinarily successful financial transaction. But it also achieved us his goal of being the largest ice cream company in the world.

Alan

So after this, this exit, you found some time to do other things. And what did you go on?

Gary

It took actually, the transaction for complicated reasons was it was three years before it closed, it was agreed to, it wasn’t subject to performance. But so there was three years until it closed. And then we had some complications with the Fair Trade Commission, the terms of de Mina said, Come on monopolist in certain respects. So we had to work through that. So it was really four years before we got the transaction closed. And then Nestle asked me to keep running the company, which I had thought about, and I said, No, there’s no way you would agree to my conditions. And he said, this, the CEO of Nestle said, Well, what are they and I told him what they were and he so of course, we can’t agree to that. I said that I told you. He called me a week later, and he said, we’ll do it. So for two years, I ran the company, but by then it was the 2007 or 2008. It was it was time to move on. So I did and I’ve done a wide variety of things since then. I was I was the first non family member of the nonfamily chairman of Levi Strauss, the chairman of Levi Strauss, when I was in college was Walter Haas, Walter Haas, senior. And he wrote me a letter that I know had a big influence on getting me into the Harvard Business School. Well as life would have it, you know, serendipity is amazing. I found myself sitting in his chair at his desk with his title, as Chairman of Levi Strauss, who would have thought, but then I went on and for other complicated reasons i i was on the Safeway board. And they elevated me to chairman at a time of transition. And I was there as we sold Safeway, for $10.7 billion dollars to a combination of Cerebus and Albertsons. That was a quite a story in and of itself. And I was chairman of the San Francisco fed, which was an amazing experience, because Janet Yellen was my president when I was chairman. And there, I was working with the former chairman of the big fed, as they call it back in Washington. And that was just an incredible experience and that I’ve been on. I mean, I’ve had wonderful experiences with these board positions, one of which, for example, is standard sauce food products, which is a tomato processor, and now an olive processor out in Stockton, California. And I’ve been on that board for 28 years, and it’s just been a joy. It’s just so much fun. I’ve got a great relationship with other people on the board and with the CEO there and working through the problems of that medium sized company. And it’s been fascinating. I’m also on the board of status of Shorenstein Realty which takes me into a whole different world of very sophisticated, very large, largely office building transactions from that very successful real estate fund company. And I can go on and on but I just seem to, I don’t get stressed, always got more to do than I can do. And I believe that the joy of life is in the doing. It’s in the journey. It’s in the struggle, and I’m just very pleased with the way life has worked out for me.

Alan

Gary, you’ve done a lot of a lot of different things. But how do you find balance in life as you’re as you’re going through the journey?

Gary

You know, I haven’t found it that difficult. I think people over stress how difficult it is. I mean, I’ve got a huge family, you know, living grandchildren, I’ve got four boys, they’re all married, they’re all happy. They’re all doing good things. And all this business activity that I’ve begun to describe here, but in addition to that, I counted up the number of pins in my map the other day and outside of the United States, right? Basically, it has been everywhere with my dryers, we had a sales office and every city in the country. I have 280 map 280 pins in my map, which means 280 separate cities. Okay, I’ve been to the North Pole. I don’t mean the Arctic, I mean, the North Pole. I’ve been to the South Pole. I don’t mean the Antarctic, I mean, the South Pole. When I did that there were only 50 People who had been to both the north and south pole. I’ve been to every single Ahmad hotel, I’ve just a junkie for that. hotel chain, and resorts. And they have they have 2030 They have 30 hotels, now I’ve been to every single one of the over the world. So I mean, I’ve my wife and I have been able to find a balance. We have wonderful family, everybody gets along. We’ve got wonderful daughters in law, we have 11 grandchildren, somehow it’s just worked out.

Alan

Gary, I’m running up against the break. I like to hold you over for one more segment they could busy here today with Gary Rogers, and we’ll be right back after these messages. Welcome back. I’m busy here today with Gary Rogers. And Gary. It’s been an amazing show. Listening to all the stories and and what you’ve been able to do over here life and I understand even wrote a book called The spirit of adventure right through. So knowing what you know, today, and having this wealth of experience and successes and experiencing failures along the way. What What message would you give to the generation of income generation today?

Gary

I think the first thing I’d say is don’t over plan. You know, I have a theory that if you get the days right, then the weeks will be right. If you get the week, right the month we’ll be right and get the months right, lawyers be right and so forth. So I take a hot tub every night for only like 10 minutes. And I think of only two things in that hot tub. Number one, how did they go? What did I do tonight? I’ll be thinking about this interview that we’ve just done. And then I think about tomorrow, what’s on for tomorrow? What am I gonna meet what, you know, what, what do I want to cover? And it isn’t being self critical. It’s just being thoughtful and prepared. And my goal is to my theory is you only get one trip around this track of life. There are no Mulligan’s. I mean, we are never going to do this interview again. Let’s make it as good as it can be, and who you’re going to have lunch with tomorrow, and what can you learn from that person. And I mean, that kind of attitude. And that also stems from a belief that life is really about serendipity. It’s very hard to plan your lots of time to young people have a five year plan or whatever. Those plans almost never work out. There’s too much just randomness in serendipity in life. But what one has to do, if you know the Boy Scouts have a motto it’s be prepared. And Louis Pasteur said a little more elegantly, he said Fortune favors only the prepared mind. And so what I find is really important is to be able to cope with opportunity that comes your way we all see much more opportunity than you think we see. And some people are prepared through schooling or experience or just instinct to turn those opportunities into things that are of value to them. And others aren’t. You know, when I look back at my life, most of the, quote successes I’ve had, I didn’t think about I didn’t plan they just kind of happened. But I was able to deal with the opportunity when it came along. I mean dryers can’t ice cream, for example. When I met I went into the dryers office to talk to them about whether they had a franchise program for ice cream dip shops, and I happened to be introduced to the then owner and CEO of dryers. And he just happened to be finishing a phone call. That was I can tell very importantly, I hung up the phone. He had tears in his eyes. And I offered to excuse myself and he said no no let me tell you what just happened. He said that was my bank. They turned me down for a loan. I desperately need to keep this company going So what do you say to someone like that? You know, I’ve just come off of an experience, I’m broke, you know, what do you say to somebody like that? Well, I knew enough to say, Have you ever considered selling the company? Most people wouldn’t do that. You know, they offered to get them another bank or to help him find some equity or whatever. But I just blurted out the words that changed my life. Have you ever considered selling the company? And he said, No, not till just now. Two days later, I had an option to buy his company for a million dollars. And he asked me how you’re going to pay me I said, I’ll give you a check. I didn’t tell him, I didn’t lie to him. I didn’t tell him it wouldn’t be my check. And I did give him a check for a million dollars. So that I mean, that’s a good example of I think the attitude that one should take, and then follow your follow your passions. You should never spend a day of this life bored or doing something that you you find distasteful or that you really don’t want to do or that doesn’t lead to something worthwhile for you. I’m not saying that every day, every week of your life is going to be fantastic. But I’ve learned that every decade of my life has been better than the preceding ones. When I was a teenager, I thought how could life be better than this driving around on my hot dog hot rod with my girlfriends? I’m not my 70s I’ve never had so much fun. Okay. So it’s a short version of my philosophy

Alan

I love a very, very inspiring and also helping to give perspective of take the risk. Enjoy the journey. That’s right. Enjoy the journey. go for the gusto. We’re busy here today with Gary Rogers, and thanks for being with us today, Gary.

Gary

It’s been my pleasure.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more interviews and updates.

This transcript was generated by software and may not accurately reflect exactly what was said.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more.

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. I’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

T. Gary Rogers is the former Chairman of Safeway Inc., which he was instrumental in selling to Albertson’s in early 2015 for $10.4 billion. Previously he was the chairman and chief executive officer of Dreyer’s Grand Ice Cream, which he and his partner, William F. Cronk, built into the largest ice cream company in the United States and then sold to Nestle in 2006 for $3.2 billion. He has also been the chairman of Safeway, Levi Strauss, the San Francisco Federal Reserve Bank, and a director of a dozen other West Coast-based companies. He is a member of the Bay Area Business Hall of Fame.

Early in his career, Rogers worked for four years as an associate at the San Francisco office of McKinsey & Co.

Prior to acquiring Dreyer’s in 1977, he and Cronk founded and ran a limited menu restaurant company, Vintage House Restaurants, which failed.

Rogers graduated from the University of California Berkeley in 1964 where he earned a Bachelor of Science degree in Mechanical Engineering. A member of the varsity crew, he was named All University Athlete in 1963 and rowed in the U.S. Olympic Trials in 1964. He has been inducted into the Cal Athletic Hall of Fame. He obtained his MBA at Harvard Business School in 1968, graduating as a Baker Scholar (top 5% of his class).

Bio courtesy of Gary Rogers.

Alan is managing partner at Greenstein, Rogoff, Olsen & Co., LLP, (GROCO) and is a respected leader in his field. He is also the radio show host to American Dreams. Alan’s CPA firm resides in the San Francisco Bay Area and serves some of the most influential Venture Capitalist in the world. GROCO’s affluent CPA core competency is advising High Net Worth individual clients in tax and financial strategies. Alan is a current member of the Stanford Institute for Economic Policy Research (S.I.E.P.R.) SIEPR’s goal is to improve long-term economic policy. Alan has more than 25 years of experience in public accounting and develops innovative financial strategies for business enterprises. Alan also serves on President Kim Clark’s BYU-Idaho Advancement council. (President Clark lead the Harvard Business School programs for 30 years prior to joining BYU-idaho. As a specialist in income tax, Alan frequently lectures and writes articles about tax issues for professional organizations and community groups. He also teaches accounting as a member of the adjunct faculty at Ohlone College.