High Property Taxes Pushing Many New Yorkers to Relocate

Recently I posted a report that the number of wealthy individuals leaving Connecticut for more tax-friendly pastures has been increasing. It seems that Connecticut isn’t the only state that is facing this problem. According to a report in the Democrat and Chronicle, New York is also dealing with more people leaving due to high taxes; and it’s not just the wealthy.

Reportedly, 41 out of 50 upstate counties in New York saw their populations decrease between 2010 and 2015. The mass exodus it seems appears to be closely related to New York’s disproportionally high property taxes. One woman from New York, who moved to neighboring Pennsylvania, now enjoys a 60 percent decrease in her property tax bill. It dropped from $5,000 annually to just $2,000.

Despite the spin that some government officials are trying to put on the numbers, the fact is that between 2009 and 2014 the state took a hit of $22 billion in wealth, with $11 billion coming between 2012 and 2014. According to financial advisors, even though it’s a tough decision, for many the taxes savings are just too much to pass up. Combined with a slow economy the high property and income taxes leave many residents with no choice but to pack up for greener pastures.

Even many of the state’s retirees are starting to worry more about New York’s high property taxes, with 56 percent saying they are concerned about being able to pay these taxes in retirement, according to a report from the AARP. In fact, 55 percent of baby boomers reportedly said they fully expect that they will leave New York when they retire, and 66 percent of the Gen-X population said they are also considering doing the same.

http://www.democratandchronicle.com/story/news/local/2016/05/11/new-yorkers-leave-states-lower-taxes/84212658/

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

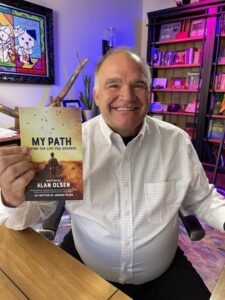

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…