How to Save Money on Your Social Security Taxes

Most people look forward to the day when they start to receive the rewards for putting all their hard-earned money over the years into social security. However, some people end up with a lot less than they had planned on because they end up paying more taxes on those benefits than they had expected. So what can you do to help lower the tax bill on your Social Security benefits?

For starters you need to know what tax table you fall into. It all depends on how much provisional income you make, which is determined by adding your adjusted gross income, your nontaxable interest and half of your Social Security benefits. If you earn less than $25,000 as a single or $32,000 for a joint return then you won’t have to pay taxes on your SS benefits.

However, as much as 50 percent of your benefits could be taxable if your provisional income is between $25,000 and $34,000 for singles and $32,000 and $44,000 for joint filers. If you surpass those figures as much as 85 percent of your benefits could be taxed.

So in order to avoid these taxes you have a few options. You can give as much as $100,000 tax free a year to charity from an IRA if you are 70.5 years or older. You can also put as much as $125,000 into a Qualified longevity Annuity Contract (QLAC). This amount does not count against you when your required minimum distribution is calculated.

Another move you can make is to withdraw money from a tax-free Roth IRA or you can roll money over from a traditional IRA to a Roth many years before you start collecting SS benefits, which will help you reduce taxes in retirement. Of course, for high net worth individuals it might be very difficult to get below the 85 percent threshold, which is why it’s important to have an overall tax-efficiency plan instead of simply focusing on saving on Social Security taxes.

http://www.kiplinger.com/article/retirement/T051-C001-S003-how-to-limit-taxes-on-social-security-benefits.html

Is Repealing Obamacare for the Better or Worse?

Is Repealing Obamacare for the Better or Worse? Since the Affordable Care Act (aka Obamacare) became law, many have decried its terms and conditions, as well as how it negatively affects so many Americans and business owners. Republican lawmakers have tried unsuccessfully to repeal it since its inception. However, that could all be about to…

The Path to Successful Entrepreneurship

The Path to Successful Entrepreneurship The road to becoming a successful entrepreneur is often long and tedious, full of trial and error and setbacks. However, for those who are able to persevere and overcome those setbacks, the rewards can be significant. The world is full of people who dream of becoming an entrepreneur. Some of…

How Full-Stack Automation Can Help Your Business

How Full-Stack Automation Can Help Your Business Are you in the cloud? If you think that refers to someone who isn’t quite in touch with reality then you need a vocabulary refresher. These days, it’s a good thing to be in the cloud and just about everyone is headed there. From large-scale businesses to an…

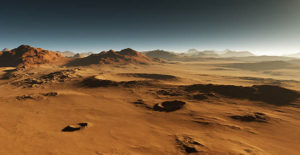

Will There Ever Be a Colony on Mars?

Will There Ever Be a Colony on Mars? Whether or not you believe in Martians or life on Mars, there is a growing movement of people here on earth that wants to pursue, at very least, space travel to the Red Planet, and in some cases an actual community of Mars-dwellers. While, living on Mars…