How to Save Money on Your Social Security Taxes

Most people look forward to the day when they start to receive the rewards for putting all their hard-earned money over the years into social security. However, some people end up with a lot less than they had planned on because they end up paying more taxes on those benefits than they had expected. So what can you do to help lower the tax bill on your Social Security benefits?

For starters you need to know what tax table you fall into. It all depends on how much provisional income you make, which is determined by adding your adjusted gross income, your nontaxable interest and half of your Social Security benefits. If you earn less than $25,000 as a single or $32,000 for a joint return then you won’t have to pay taxes on your SS benefits.

However, as much as 50 percent of your benefits could be taxable if your provisional income is between $25,000 and $34,000 for singles and $32,000 and $44,000 for joint filers. If you surpass those figures as much as 85 percent of your benefits could be taxed.

So in order to avoid these taxes you have a few options. You can give as much as $100,000 tax free a year to charity from an IRA if you are 70.5 years or older. You can also put as much as $125,000 into a Qualified longevity Annuity Contract (QLAC). This amount does not count against you when your required minimum distribution is calculated.

Another move you can make is to withdraw money from a tax-free Roth IRA or you can roll money over from a traditional IRA to a Roth many years before you start collecting SS benefits, which will help you reduce taxes in retirement. Of course, for high net worth individuals it might be very difficult to get below the 85 percent threshold, which is why it’s important to have an overall tax-efficiency plan instead of simply focusing on saving on Social Security taxes.

http://www.kiplinger.com/article/retirement/T051-C001-S003-how-to-limit-taxes-on-social-security-benefits.html

The Chips Bill is Set To Clear, Episode 23 by Ron Cohen

This week we discuss how Senate Democrats are pur…

Episode 22: Joe Manchin Blocks The Build Back Better Bill Again

In this episode we cover, how Joe Manchin blocks The Build Back Better Bill again, Hungary wants to be left alone, more proposed Low Income Housing Credits, and the 3.8% tax expansion proposal is criticized by the real estate industry. Tax Update with Ron · Episode 22, Joe Manchin Blocks The Build Back Better Bill…

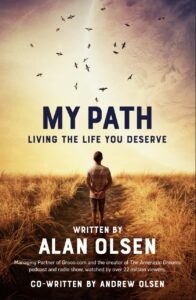

Exciting American Dreams Show News, The First Book!

I have some exciting American Dreams Show news. The host, Alan Olsen has written the first book based on the AD interviews! Other books have cited one or more of the interviews, but this one goes into far more details. Below is a letter from author himself describing the book… From Alan… Dear Friend, I…

Episode 22, Joe Manchin Blocks The Build Back Better Bill Again

In this episode we cover, how Joe Manchin blocks …