How Will the New President Change Taxes for the Wealthy?

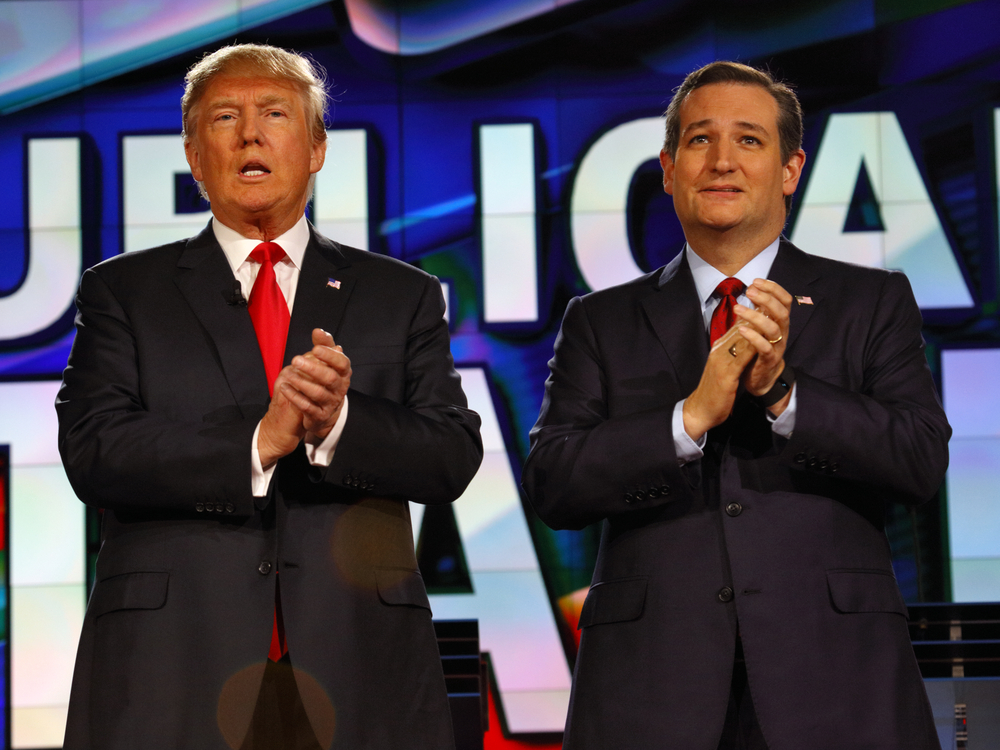

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Add These Historical U.S. Sites to Your Bucket List

Add These Historical U.S. Sites to Your Bucket List Are you a history buff? There are so many places in the country to see if you want to experience some of the things that helped make this country what it is today. Of course, there are many well known sites that would make any history…

How to Build Emotional Intelligence

How to Build Emotional Intelligence IQ vs. EQ and how that affects you Throughout childhood teachers are quick to pick out students who are “high performers” and have a high IQ. With society giving such a larger emphasis on IQ, it is inferred that only those who have a high IQ will be successful financially…

Leadership Through Crucial Conversations

Leadership Through Crucial Conversations Think of a time where you had a difficult conversation with someone, the kind where emotions are strong, and the stakes are high. It could be on a variety of topics: negotiating a raise at work, having to fire an employee, or even how to tell your spouse that you don’t…

The Top Benefits of Floating Therapy

The Top Benefits of Floating Therapy Have you ever felt so good that you “feel like you’re walking on air?” Of course, that’s just an expression, but what if you could get that kind of feeling in a real-world experience? Life is stressful and people are always looking for new ways to catch a breather,…