How Will the New President Change Taxes for the Wealthy?

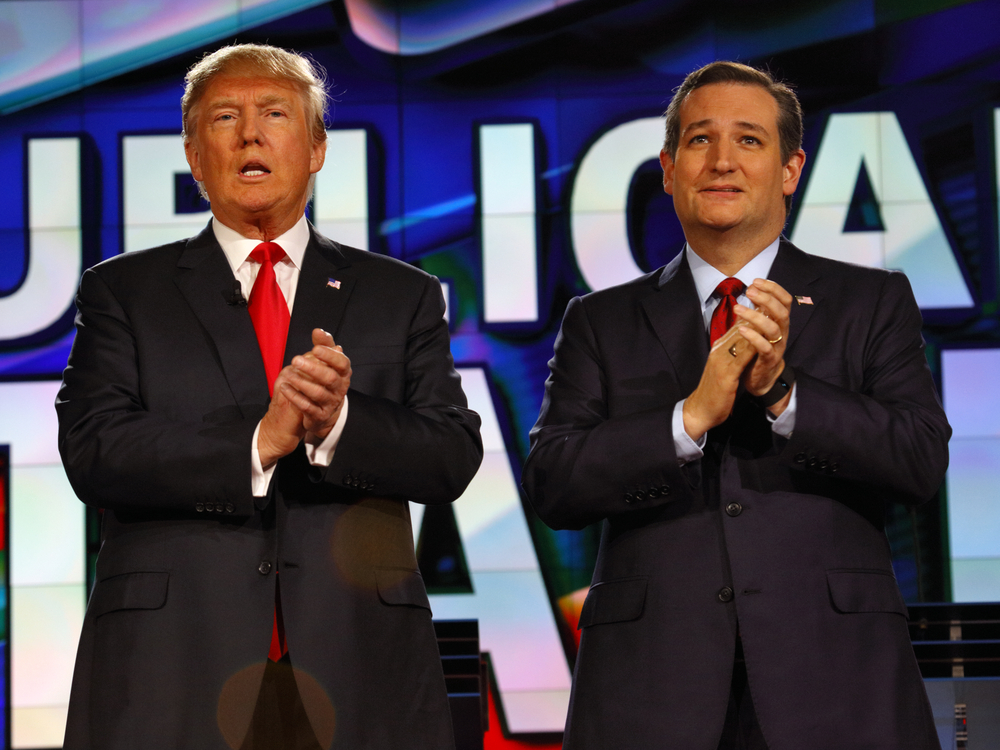

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

The Miracle Behind the Growth of The Stock Market

The growth we’ve experienced in the last four decades in the economy as well as in the stock market is nothing short of a miracle. I attribute much of this growth to advancements in technology- specifically computer processors. Prior to the 1970’s computers were as big as refrigerators and operated in cool storage rooms. In…

How Income Taxes Became Part of The Constitution, Ron Cohen Episode 26

8/23/2022

This week we talk about:

What you need…

Craig Stanland – Reinvention Architect and Mindset Coach

Craig Stanland – Reinvention Architect and Mindset Coach Interview Highlights After hitting rock bottom, Craig Stanland was forced to make a choice: give up or rebuild. He thought he had “it all” until he lost sight of what’s truly important and made the worst decision of his life, losing everything along the way, including his…