How Will the New President Change Taxes for the Wealthy?

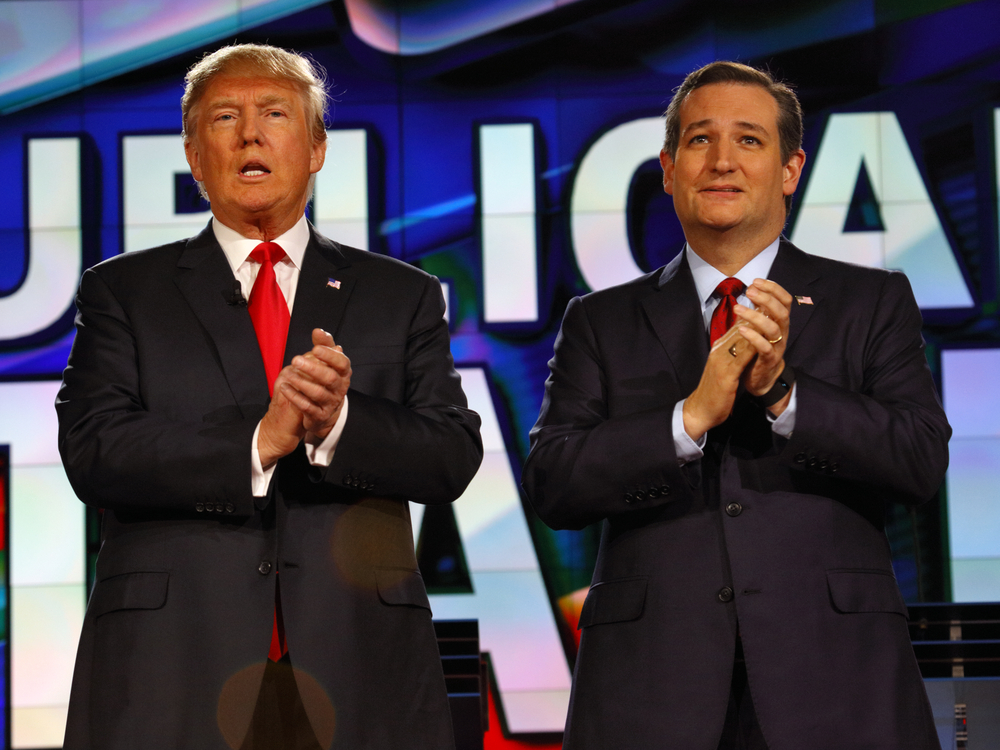

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

It’s Time for a Tax Scam Refresher Course

Despite repeated warnings from the media and the IRS alike, thousands of people are conned out of money every tax season by scammers. Make sure you’re not one of them. Here is a list of some of the most common scams the IRS sees this time of year. The list is not all-inclusive, as scammers…

Believe it or Not, So Far the IRS Is Refunding More Money This Year

It’s a rarity that anyone ever has anything good to say about the IRS; just as it’s a rarity that the federal tax agency has good news for taxpayers. However, according to recent reports, the IRS does have some very good news to share in regards to tax returns so far in 2015. While earlier…

IRS Guilty of Questionable Hiring and Rehiring Practices

How confident are you that the IRS is going to handle your tax return properly? Even if you’ve already filed, this latest news could affect you. According to new reports, the IRS apparently used some questionable hiring practices as it prepared to begin reviewing the roughly 150 million individual tax returns it expected to receive…

Tax Season Got You Down? Blame Obamacare

What do you hate the most about taxes? Is it the simple fact that you have to file them? Is it the fear of being chosen for an audit? Is it all the confusing changes on tax laws and policies that drive you nuts? There are a lot of reasons people hate dealing with taxes,…