How Will the New President Change Taxes for the Wealthy?

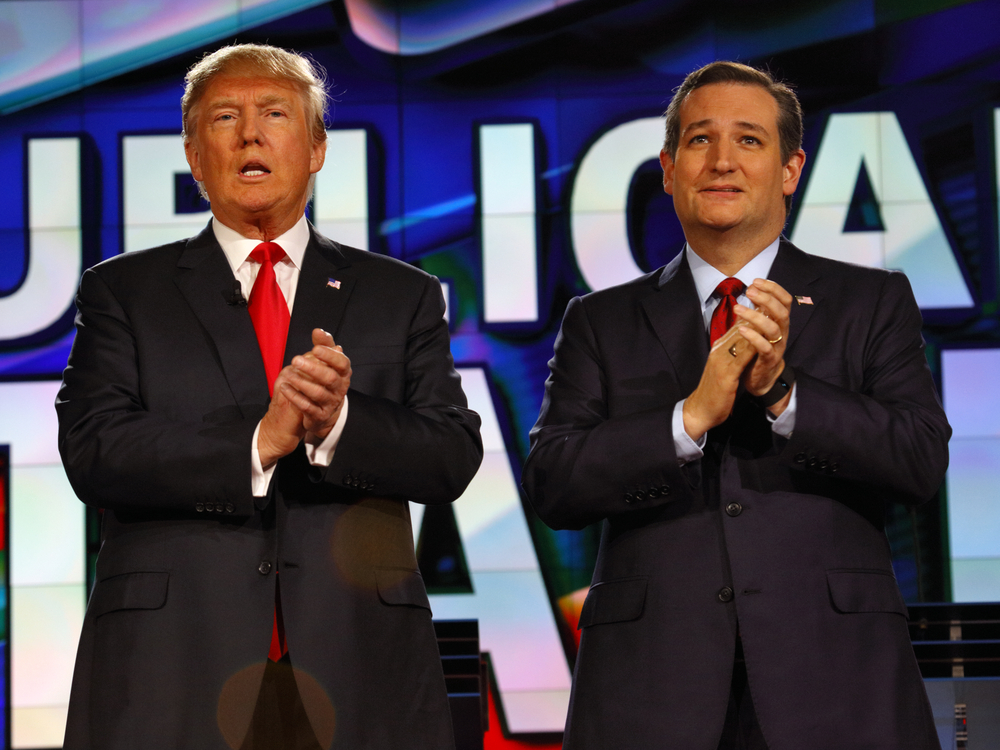

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Expecting An Audit? Expect to Wait

Expecting An Audit? Expect to Wait Have you ever been audited by the IRS? Have you been told that you might be audited soon? Are you waiting to be audited right now? If you answered yes to any of these questions, then chances are you have either played the waiting game or you’re playing it…

Seven Signs Your Noncompliance Will Be Considered Willful

Seven Signs Your Noncompliance Will Be Considered Willful There are many ways taxpayers can get the attention of the IRS. Although a lot of people make innocent mistakes when they file their tax returns, there are others who willfully look for ways to skip out on the taxes they owe. The IRS does treat those…

Make Sure Your Heirs Inherit What You Want

Make Sure Your Heirs Inherit What You Want. The saying goes that their only two things that are certain in life: death and taxes. While people can generate endless amounts of money when they’re alive, they can’t live forever and they can’t take that wealth with them when they die. However, they can have a…

Will Taxing the Rich Even More Improve Inequality?

Will Taxing the Rich Even More Improve Inequality? It’s been the cry of democratic lawmakers and many of the less fortunate for years: “We need to tax the wealthy even more.” “The rich have to pay their fair share of taxes, too.” The problem is the rich already pay a huge portion of the country’s…