Huge Decisions Loom for Lawmakers on Obamacare Taxes

One of the biggest calling cards of the Republican Party for the last several years, including President Donald Trump, has been to repeal the Affordable Care Act, also known as Obamacare. Although Obamacare has faced much opposition throughout its existence, recent polls suggest that most Americans don’t want it repealed, especially if there is nothing to replace it.

Still, republican lawmakers are undeterred in their efforts to scrap it. However, there are several significant taxes issues that must resolved, namely which taxes should they repeal. Make no mistake, republicans hate the Obamacare taxes, but some feel that they should keep them to help pay for their replacement plan. The taxes in question include:

- Net Investment Income Tax – this would automatically eliminate the 3.8 percent tax on capital gains.

- Health Insurance Tax – Health insurance providers are forced to pay this annual fee based on their market share.

- Medicare Surtax – This tax on the wealthy created an extra $7.3 billion for the government, so eliminating it would help anyone earning more than $200,000 (single filer) or $250,000 (joint filer) a year.

- Cadillac Tax – this is set to begin in 2020, but many lawmakers from bot sides oppose it, as it would be a huge tax on those with high-cost health plans, including many democratic-backed unions.

- Prescription Drug Tax – repealing this would help businesses that make or import branded prescription drugs and have to pay huge fees for doing so.

- Tanning Tax – this contributed to many tanning salons going out of business

- Medical Expenses Deduction Cap – this raised the threshold for deducting medical expenses from 7.5 percent to 10 percent.

- Flexible Spending & Health Savings Accounts – these placed lower limits on the amounts people can add to them and raised the penalties for using the money on anything other than medical expenses.

- Mandate Penalties – these are the penalties that people must pay if they choose not to have health insurance.

Each of these taxes could en up on the chopping block, but it remains to be seen which ones will be officially repealed and which ones will survive.

http://thehill.com/policy/finance/317880-gop-faces-big-decision-on-obamacare-taxes

Venktesh Shukla: His Journey into the VC World

Interview Transcript, Venktesh Shukla: His Journey into the VC World: Alan Olsen: Can you tell us a little about your background? Venktesh Shukla: I was born and brought up in India. I did bachelor’s in electrical engineering my sister was in US and she thought that every self-respecting electrical engineer should be in Silicon Valley so…

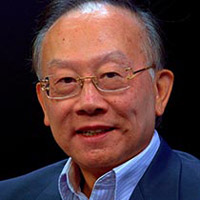

Henry Wong, Founder of Diamond Tech Ventures

Interview Transcript, Henry Wong, Founder of Diamond Tech Ventures: Alan Olsen: Welcome back I’m visiting here today with Henry Wong. He’s a venture capitalist here in Silicon Valley and the founder of Diamond TechVentures. Welcome to today’s show. Henry Wong: Thank you. Alan Olsen: Now you’ve done a lot in your career, but so for…

How to Stop Cyber Criminals From Stealing Your Info

How to Stop Cyber Criminals From Stealing Your Info Tax season has come and gone, and we won’t have to worry about the next one for several months. But just because you’re taking a rest from taxes, it doesn’t mean potential cyber criminals are too. Cyber criminal activity is on the rise and these scammers…

Gates Not Opposed to Wealth Tax Despite Implications

There has been much chatter lately regarding a wealth tax. At least two of the leading democratic presidential candidates have discussed it, even though most wealthy Americans would likely oppose this tax. After all, why should they be punished just because they make more money? But not all wealthy taxpayers oppose a wealth tax. In…