Is Your 2015 Tax Plan Ready?

How did your 2014 tax season go? Was it a success, or did it lack something to be desired? Did you get a nice return, or did you end up owing the IRS more than you expected? Did you make any mistakes when you filed your taxes or discover after the fact that you missed out on a credit or deduction you could have qualified for? Let’s face it, people aren’t perfect and taxes are complicated. Put those two things together and maybe your tax season could have been better.

Important Questions to Ponder

So now that your 2014 taxes are over and done with, maybe now is the time to consider some important changes for next year. In order to do this try asking yourself some of these important questions:

- Do I have the right tax advisor? – Any CPA can file a tax return, but you need to be certain that your CPA understands the tax code inside and out and that he/she gets you the best results possible before and after your return.

- Does my wealth manager understand tax loss harvesting? – While many wealth managers can help you plan for the present and the future, one key ingredient to success is to understand tax loss harvesting and how to use it.

- Do I pay enough in fees? – No one wants to pay more than they have to, but if your hire an accountant on the cheap, you will probably get what you pay for. Paying a little extra to make sure your CPA digs deep enough to find every possible credit and deduction is worth the price.

- Is my team right for me? – Some people have good accountants that also try to help manage their wealth, or vise versa. In most cases, it’s a good idea to have two separate advisors. However, it’s up to you to make sure you put together the right team for your success.

GROCO Can Help

All of these are important questions that you need to ask yourself. If you need help with any of these questions you can contact GROCO. Our team can help you with your investments, tax planning and wealth management. Just contact us online or give us a call at 1-877-CPA-2006 for more help.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

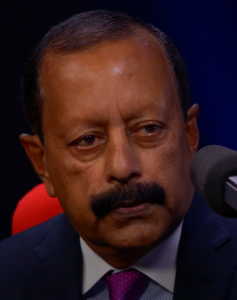

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…