Lawmakers Vote To Make Three Tax Provisions for Businesses Permanent

Late last year lawmakers in Washington extended a bill that made three important tax provisions for businesses valid through December 31, 2014. That means those provisions were good for last year’s taxes, but expired when the clock struck midnight on January 1, 2015. The extension was welcome news last year for many businesses. Now there is more good news, as Congress recently voted to make those provisions permanent with a new bill: HR 636.

The three provisions in question are Section 179, Section 1374 and Section 1367(a)(2). With the Section 179 provision taxpayers would permanently be allowed to expense up to $500,000 in qualified assets, instead of just a mere $25,000 without the provision. That is a huge break for many businesses.

Provision Section 1374 has to do with corporations and how they pay taxes. S Corporations typically don’t pay corporate–level taxes. However, C corporations do pay those taxes. When a C corporation chooses to become an S corporation it and purges its assets within a 10-year period it must pay a tax on those gains. However, with Provision 1374 in place the waiting period is cut in half to just five years.

It used to be that when an S Corporation donated appreciated property to a charity it qualified for a fair market value deduction. The shareholders were then required to reduce their basis in the S Corporation’s stock. However, under the Section 1367 provision, those shareholders simply have to reduce their basis according to their share of the adjusted basis of the property that was donated.

If these provisions are passed and become law, they would greatly benefit small businesses. By knowing these provisions are permanent year-round, businesses would be able to better plan their purchases and sales throughout the year. Hopefully this bill is passed by the Senate and signed by the president.

Is Repealing Obamacare for the Better or Worse?

Is Repealing Obamacare for the Better or Worse? Since the Affordable Care Act (aka Obamacare) became law, many have decried its terms and conditions, as well as how it negatively affects so many Americans and business owners. Republican lawmakers have tried unsuccessfully to repeal it since its inception. However, that could all be about to…

The Path to Successful Entrepreneurship

The Path to Successful Entrepreneurship The road to becoming a successful entrepreneur is often long and tedious, full of trial and error and setbacks. However, for those who are able to persevere and overcome those setbacks, the rewards can be significant. The world is full of people who dream of becoming an entrepreneur. Some of…

How Full-Stack Automation Can Help Your Business

How Full-Stack Automation Can Help Your Business Are you in the cloud? If you think that refers to someone who isn’t quite in touch with reality then you need a vocabulary refresher. These days, it’s a good thing to be in the cloud and just about everyone is headed there. From large-scale businesses to an…

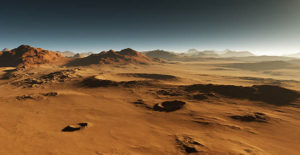

Will There Ever Be a Colony on Mars?

Will There Ever Be a Colony on Mars? Whether or not you believe in Martians or life on Mars, there is a growing movement of people here on earth that wants to pursue, at very least, space travel to the Red Planet, and in some cases an actual community of Mars-dwellers. While, living on Mars…