Should You Pay Estimated Taxes?

For most people tax time only comes once year. However, for anyone who has to pay estimated taxes a large tax bill could be due several times a year. Again, most people do not have to worry about paying estimated taxes, but there are several circumstances that will put you in that category. The most common reason people need to pay estimated taxes is because they have self-employment income, but there are other reasons as well. You may need to pay estimated taxes if any of the following apply to you.

- You or your spouse earned self-employment income.

- If the stock market was kind and you cashed out a large portion of your gains, but you did not adjust your withholding on your W-4, then you might need to pay estimated taxes.

- If you hire a nanny and pay her federal payroll tax for her, then you can make those in quarterly estimated taxes.

- Any income you earned that was not subject to federal withholding on your W-4 could be subject to estimated taxes.

Not everyone who falls into one of these categories needs to pay estimated tax. So how do you decide if you should or shouldn’t pay these taxes? There are many answers to this question, but the bottom line is if you made enough income from untaxed sources that you will cause you to owe taxes when you file your return then you should make estimated tax payments. If you fail to do so, then you could pay a penalty. On the other hand if your deductions and credits will be more than the tax amount you would owe on this income then you are most likely OK in skipping these estimated payments. If you still aren’t sure whether or not you should make estimated tax payments, then contact us at GROCO for more advice. We can look at your situation and help you determine if these payments are necessary. Please contact us for help at 1-877-CPA-2006, or click here.

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

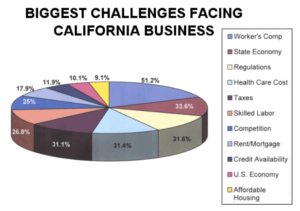

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…