Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

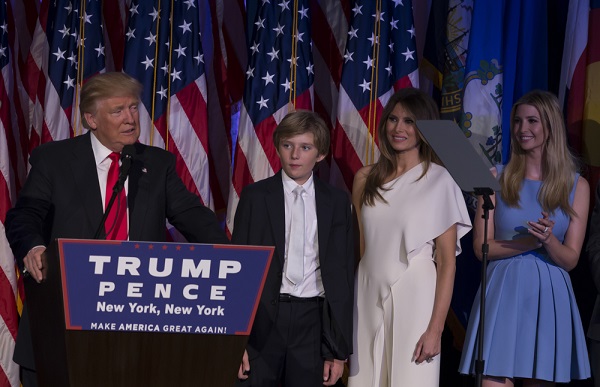

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

More Companies Offering New Way to Lower Taxes on Pensions

More Companies Offering New Way to Lower Taxes on Pensions By Alan Olsen It used to be that many, if not most, companies offered the benefit of a pension fund to those employees who eventually retired with the company after many years of service. As times have changed, benefit packages have become less attractive or…

Doing Business in China – Common War Stories

Doing Business in China – Common War Stories As time passes, I hear from reliable sources the same type of stories, over and over, about doing business in China. So, I thought I’d pass along some recent reviews: Assume a taxpayer sets up a Wholly-Owned Foreign Enterprise (W.O.F.E.) and manufactures products (directly or via a…

Even the Ultra Wealthy Need Smart Financial Planning

Even the Ultra Wealthy Need Smart Financial Planning By Alan Olsen, CPA, MBA (tax) Managing Partner Greenstein Rogoff Olsen & Co. LLP How many times have you heard about an ultra-wealthy individual who has somehow managed to blow all of his or her fortune and end up with practically nothing? There are countless stories of…

Top 12 Tax Planning Tips for 2010

Top 12 Tax Planning Tips for 2010 By Alan L. Olsen, CPA, MBA (Tax) Greenstein, Rogoff, Olsen & Co., LLP Posted: 12/22/2010 Washington’s ‘gift’ to tax payers was signed into law by President Obama on December 17th. While the argument is still raging behind closed doors, we the tax payers now have some additional clarity…