Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

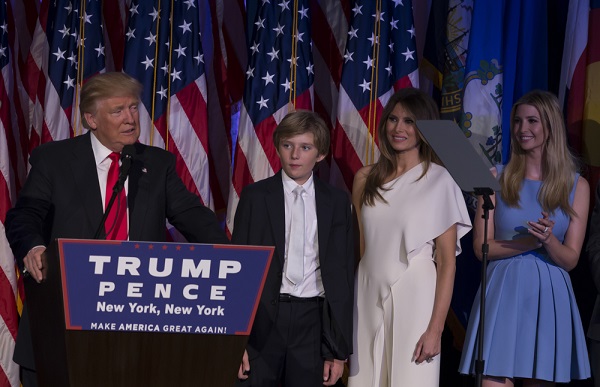

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Bad Attitudes in the Workplace

Bad Attitudes in the Workplace Studies show that employee morale has taken a hit lately. Worker morale slumped last year, according to the results of a new survey from Randstad, one of the world’s largest professional employment services providers. The review was compiled from 3,233 online interviews, conducted this spring for Randstad by Harris Interactive.…

The Language of Wills

The Language of Wills Many professions and disciplines have their own vocabulary. As an example, think about the terminology used in medicine and law. Often this vocabulary defines complex ideas, yet just as often “terms of art” can be defined with relative ease to a layperson. Such is the case with much of the language…

3 Strategies to Convert Perfectionist Paralysis Into Productivity

3 Strategies to Convert Perfectionist Paralysis Into Productivity By Paula Eder Time management tips help you break time habits that hinder your progress. For example, think of habitual perfectionism as the ultimate time goblin. The more of your time you feed it, the larger and more tyrannical it becomes. Fortunately, perfectionism is a learned behavior…

Venture Capital: Investing In The European Marketplace

Venture Capital: Investing In The European Marketplace By Stephen McLaughlin As anyone who has ever tried it knows, As anyone who has ever tried it knows, venture capital investing is not a game for the weak of heart. While it is certainly true that some venture capitalists have accumulated massive investing is not a game…