Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

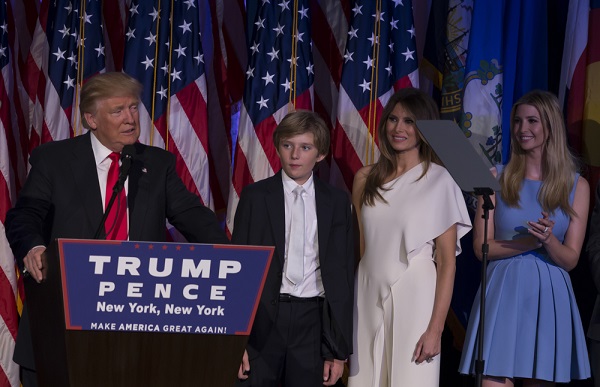

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Don’t Get Bit By Hidden Taxes in Retirement

Don’t Get Bit By Hidden Taxes in Retirement Just about everyone hates taxes. They’re complicated and they often seem too high for moat taxpayers. Keeping track of the constantly changing laws and regulations can be unbearable for many, as well. So what about when you retire? Things will get a lot easier when you quit…

Best 2018 Work From Home Jobs

Best 2018 Work From Home Jobs Do you have extra free time you wish you could turn into extra money? As times are changing, so are the ways to earn money! If you area stay at home mom or dad, between jobs, retired, or could just use a little extra coin, work-at-home opportunities are growing…

How to Pull True Leadership From Within

How to Pull True Leadership From Within Are you a natural born leader? The truth is no one is born a leader. Yes, many people do have innate leadership qualities about them. But they still have to learn how to use those qualities and attributes to become a great leader. So how do you learn…

The Rise of Big Data and What it Means for Today’s Leaders

The Rise of Big Data and What it Means for Today’s Leaders In 2016, we interviewed Shane Greenstein, author of How the Internet Became Commercial. As he laid out his arguments, it became evident that the big data revolution was imminent. The professor noted that the internet contributed significantly to data collection in the business…