Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

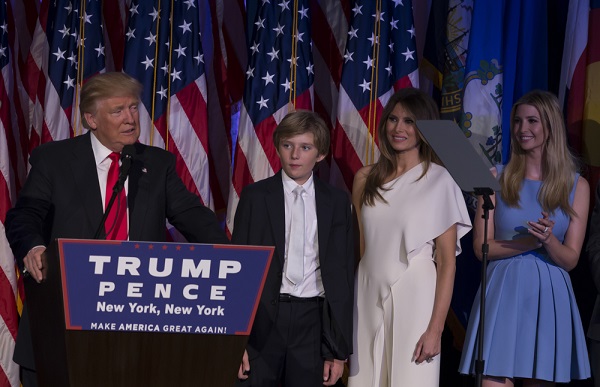

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Will the IRS Stop States From Avoiding Tax Deduction Caps?

Will the IRS Stop States From Avoiding Tax Deduction Caps? By far, one of the most controversial aspects of the new Tax Cut and Jobs Act (TCJA) has been the reduction in the state and local income tax deduction. This has long been an important deduction for many people. Being able to deduct your state…

Principle Based Leadership

Principle Based Leadership Transformational Leadership Series: What is a leader? Or better, what is a leader’s role in an organization? If the answers to these questions could be culminated to one single sentence it would be: to execute the mission of the organization in the most efficient, effective, and ethical manner, at the highest level.…

Could the Recent Tax Overhaul Lead to a Bear Market?

Could the Recent Tax Overhaul Lead to a Bear Market? It took years to get there, but the major tax reform set in motion, and eventually passed into law by Republican lawmakers in Washington has had a profound affect on the stock market. The Tax Cut and Jobs Act (TCJA) has already given a big…

How to Boost Employee Engagement With One Simple Practice

How to Boost Employee Engagement With One Simple Practice Any manager, business owner, or company leader will tell you they would like to improve employee engagement. Employee engagement, after all, is a vital part of any company’s success. However, this is much easier said than done. Performance reviews are old fashion and typically make employees…