Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

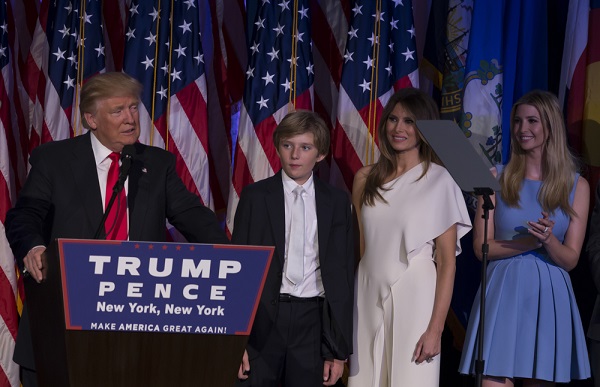

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Tax Season Got You Down? Blame Obamacare

What do you hate the most about taxes? Is it the simple fact that you have to file them? Is it the fear of being chosen for an audit? Is it all the confusing changes on tax laws and policies that drive you nuts? There are a lot of reasons people hate dealing with taxes,…

Have a Tax Issue With the IRS? You Could Always Take Them to Court

What would you do if the IRS makes a decision you don’t agree with? For example, let’s say you file a tax return and send it in expecting to receive a refund of $1,500. However, a few weeks later, instead of receiving your refund, you get a letter in the mail informing you that you…

Will Fewer Audits Lead to More Cheating?

There’s an old saying that cheaters never prosper. Of course, there are probably many people who have gotten away with cheating that would beg to differ. When it comes to taxes, however, it’s always best to avoid cheating. Surely, some people do get away with it, but if you ever get caught it could cost…

Could a Trust Be a Good Way for the Wealthy to Save on Taxes?

When you think of trusts, what comes to mind? While many people think of a financial account that is set up as part of an estate plan, there are a couple of little-known trusts that taxpayers, especially the wealthy, can use to help them save on their tax bill. These trusts are perfectly legal and…