Tax Policy Center Claims Trump Child Care Plan Favors the Rich

Although most of President Trump’s policies have greatly divided the country, one policy that everyone can agree upon is lowering the cost of childcare. However, what they don’t agree on is how to make that happen. So far, his proposals have been well received by the right and not so much by the left. Shocking, right?

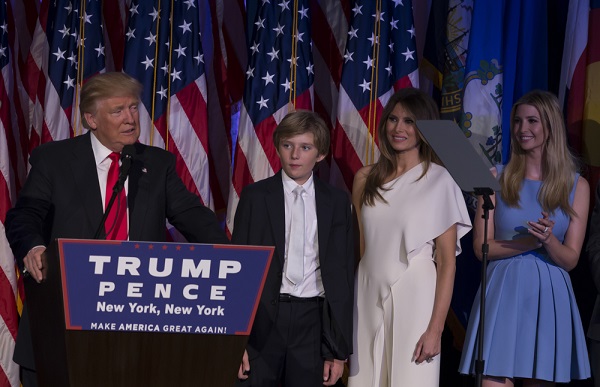

Trump made reducing the cost of childcare one of his campaign promises and even included it on his contract with America. His Daughter Ivanka Trump played a big role in creating the plan, which would provide more paid family leave for new parents and help increase the tax benefits to parents who have to pay for childcare, and even to some who don’t.

However, the problem is, according to the non-partisan Tax Policy Center, the president’s new plan will really only help the wealthy. The Tax Policy Center claims that 70 percent of the proposed benefits would directly help families that make at least $100,000. Meanwhile, more than 25 percent would go to anyone who earns $200,000 or more.

The plan also calls for a refundable tax credit for lower income families with parents that don’t end up owing any federal income tax. The most they could receive would be $1,200, but most families would end up with much less. Plus, parents who stay home wouldn’t be eligible for the tax credit, but wealthier parents that don’t work could still take advantage of the tax deduction.

http://money.cnn.com/2017/02/28/news/economy/donald-trump-child-care/

Charles Sullivan- A Legacy of Football, Entertainment & Medicine

Charles Sullivan, A Legacy of Football, interview transcript, by Alan Olsen for The American Dreams Show: Alan Olsen: Can you share a little about your background with us? Charles Sullivan: Yes, my late father during the Second World War was assigned to the US Naval Academy at Annapolis, Maryland. And he was director of public…

Jory Mack- Reno Solar

Jory Mack, Reno Solar, interview transcript, by Alan Olsen for The American Dreams Show: Alan Olsen: Can you share a little about your background and how your company, Reno Solar came about? Jory Mack: I was working at a gym and had a friend that, that wanted to be partners. I basically I quit the…

Tax Planning December 2020: Biden vs Trump

Tax Planning December 2020: Biden vs Trump Transcript: There is a lot going on in terms of to sorting out the Presidential election right now. Regardless of who becomes President, January 1st is approaching fast and there are still opportunities to take action to do some tax planning before year end. When we’re looking between…

The New Normal for a Successful Mindset

What is the new normal for a successful mindset? The pandemic has forced us to think differently and to quickly adapt to changes we would have previously considered very unlikely. It is not good luck, rather a strong and responsible leadership ethic of any company fully prepared to change to a Work-from-home scenario when the…