These Situations Could Lead to a Higher Tax Bill This Year

Unless you’ve filed for an extension then the tax deadline is officially upon us. That means you need to get your taxes in pronto, if you still haven’t. While most people hate doing their taxes, they do enjoy the typical reward after the hard work is all done: a nice refund check.

However, there is no guarantee that you will get a refund. In fact, it’s entirely possible that you could end up owing the IRS some money, even if you weren’t expecting to. That’s because there are certain life events and decisions that can end up putting you in the red instead of the black.

For example, if you have started a side business there is a good chance you could end up owing more in taxes than you expected. If you don’t plan ahead and you don’t make any estimated tax payments on that additional income, you will owe some extra money when you report it come tax time.

Getting married or filing for divorce can also impact your tax status greatly. If you change your filing status to married filing jointly, you could end up owing more than you did when you filed as a single. Additionally, when you get divorced you might end up losing some of the deductions you once enjoyed when you were married.

There are several other events in life that could negatively affect your tax bill, including selling your home, withdrawing money from a retirement account, losing your job, winning prize money or receiving an inheritance from someone. The bottom line is, there are several things that can affect your tax bill, so make sure you track everything and be prepared for the worst. As always you can contact us at GROCO for more tax help.

http://www.denverpost.com/2017/04/09/surprise-tax-bill

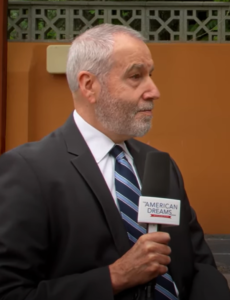

Allen Miner – SunBridge Group

Interview transcript of Allen Miner, SunBridge, by Alan Olsen, Host of the American Dreams Show: Alan Olsen: Welcome back and visiting here today with Allen Miner. He’s the CEO and founder of the Sunbridge group. Welcome to today’s show. Allen Miner: Great to be here. Alan Olsen: So Alan for the listeners, can you…

2X Wealth Group: Investment Management Catered to Women | Lori Zager

“2X Wealth Group: Investment Management Catered to Women”, Lori Zager Transcript, Interview by Alan Olsen, Host of The American Dreams Show: Alan Olsen: Welcome back. I’m here today with Lori Zager. She is the co founder of the 2X Wealth Group which is a subsidiary of Ingalls & Snyder. Lori, welcome to today’s show. …

John Hoffmire

Transcript of John Hoffmire: Alan Olsen: One of the areas that you’ve been involved with is impact investing, what is impact investing? John Hoffmire: Well, impact investing can be defined as a number of different ways. I’m going to define it in the broadest possible way, where investments of almost all types make an…

Add These Leadership Skills for 2021

As we begin to exit the pandemic, are you looking to grow or enhance your leadership skills this year? If so, it is vital to have a plan as no one can expect to become a better leader just by showing up every day. Here are some important things to focus on in 2021. These leadership…