What Should You Do if You Can’t Afford to Pay Back-Taxes?

Paying taxes is no fun. Owing back taxes and not being able to pay them is much worse. Many people get into tax trouble when they end up owing money to the IRS and they don’t have the means to pay it off. This can cause a lot of stress, anxiety and even fear or panic. However, you shouldn’t panic. The IRS won’t show up at your door with the police ready to take you away in handcuffs.

If you do end up owing back taxes and you can’t pay them off all at once, you have some options. That’s because the IRS is willing to work with you, so long as you are willing to work with them. The first thing you should do, is file your return on time, even if you know you don’t have the money to pay off your tax debt. This will help you avoid additional late-filing penalties.

Pay as much as you possibly can when you file your return. If you just need a little more time then you can file for a short-term extension in order to pay off the remaining debt within 120 days. If it is going to take longer, then apply for a monthly payment plan with the IRS. It’s best to set up an automatic monthly payment plan. There will likely still be interest and some penalties but they will be much lighter.

The IRS wants you to be able to pay your taxes and they are willing to work with you if you keep up your end of the agreement. You can learn more about paying off back taxes by clicking here.

Charitable Donations May Avoid Capital Gains Tax

Charitable Donations May Avoid Capital Gains Tax Charitable donations may avoid capital gains tax if structured properly. Many family offices choose to be engaged in philanthropy at some level. Unfortunately, selling stocks and other securities in order to make a charitable donation often results in the need to pay capital gains tax. One way to…

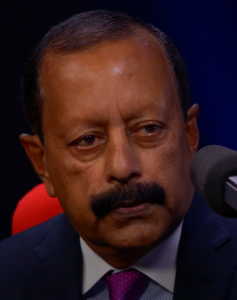

Service Through Public Health | Dr. Jacob Eapen

Transcript: Alan Olsen: Can you share a little about your background? Dr. Jacob Eapen: I was born and brought up in India in a southern part of Indian, a state called Kerala. Did my undergraduate, Doctorate and did my post graduation there and moved to Africa where I was a consultant pediatrician for a…

Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan

Interview transcript for the American Dreams Show “Holding the Sun, Poems of Inspiration from the Travels of DeAnna Morgan”: Alan Olsen: Your husband, Randal Morgan, has a documentary film degree out of Stanford, how did get involved in helping with documentaries and what role was that? DeAnna Morgan: I always was in the background with…

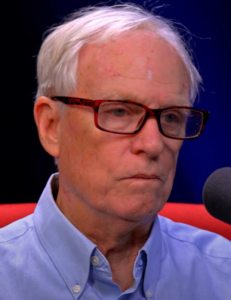

The Man Behind Morganstar Media | Randall Morgan

Interview transcript of Randall Morgan for the American Dreams Show, “The Man Behind Morganstar Media”: Alan Olsen: Can you tell us about your background and how you ended up working with Jane Goodall? Randall Morgan: I was a graduate student at Stanford, and had just finished my masters in documentary film, in walks Jane…