When Is the Best Time to Exercise Those Stock Options?

We hear about stock options all the time in the news. It seems like anytime a big company is involved in some sort of financial transaction the term “stock options” is thrown around at some point. First off, stock options are an option given to a person, usually an employee, to purchase stock in a company at a fixed or discounted rate.

So perhaps you have been given some stock options and now you’re starting to wonder when you should exercise those options. Before you choose to move forward there are several things to consider.

- Your company’s plan

- Your company’s growth

- Your current financial needs

- Keeping your portfolio balanced

- Current market conditions

- The tax implications

Each of these factors is important and you should weigh each of them when you are considering exercising your stock options. If you would like to learn more about each of these important factors in regards to stock options and when might be the best time for you to exercise them, then click here.

You can also contact us at 1-877-CPA-2006 or click here to contact us online. We can help walk you through all the different aspects of stock options and give you a better idea of when the best time to make the investment might be for your particular situation.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

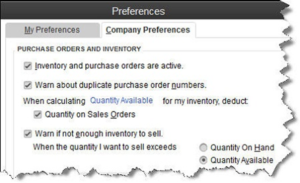

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…