Will Latest Group Lottery Winner Be Affected by Taxes?

There is nothing quite like winning the lottery. In almost all cases lotto winners go from rags to riches overnight. There is definitely a thrill and exhilaration that comes with becoming an instant multi-millionaire. Who wouldn’t want to win the lottery? Hold that thought. Winning the lottery comes with several possible catches that could lead to tax trouble. In fact, for some lottery winners, the tax fallout is a real nightmare.

The tax headache can be especially big when several people decide to purchase lottery tickets together, as a group, which is exactly what happened to some recent lottery winners in Tennessee. Twenty co-workers won a $420.9 million Powerball jackpot in November, with the lump sum payment being $254 million. Split evenly, each winner will receive $12.7 million before taxes.

However, the first question that must be answered is could this group be considered a real partnership? The 20 winners have been pooling their money together for eight years, so it’s a legitimate question. It’s also an important one as it could make a big difference in how they report it and their overall tax bill.

Another question is could their agreement be viewed as a trust? If the IRS considers it a grantor trust it’s simply taxed as a flow-through. However, if it is a more complex trust that is taxed the same as a corporation the tax headache can be huge and expensive. So, what should you do if you become an instant millionaire? If you ever end up choosing the right numbers, the smartest thing to do is talk with a qualified tax professional before you even collect the money. This will help you avoid several possible headaches.

http://www.forbes.com/sites/robertwood/2016/12/01/20-plant-workers-420-million-powerball-win-cleverly-misses-tax-mess/#3a6f0e555f29

Unveiling Entrepreneurial Success with Randi Brill

Randi Brill, best-selling author and CCO of Just Call Randi Design Agency discusses unveiling entrepreneurial success on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Randy brill. Ready welcome to today’s show. Randi Brill Thank you, Alan. I’m glad to be here. …

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

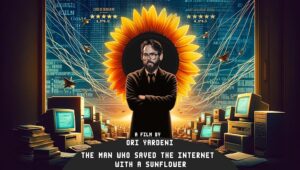

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…