Will Your Tax Return Draw the IRS’s Attention?

No one wants to experience a tax audit. The good news is that most people never will have to go through that experience. The IRS simply doesn’t have the time and resources to audit every tax return. In fact, the IRS only audits about 1 percent of all returns. That means most people don’t have to worry about being audited. However, if you want to be extra careful and decrease your odds off being chosen even more, there are some tips to keep in mind when you file your tax return.

There are some red flags that could increase your chances of catching the IRS’s all-searching eye. Here are a few of them:

- You make a lot of money

- Your deductions are higher than normal

- Your charitable deductions are high

- You don’t report all taxable income

- You own or run a small business

- You claim the alimony deduction

- You claim a loss for a hobby

- You claim rental loss

- You deduct a lot of business expenses: travel, entertainment and meals

- You don’t report a foreign business account

- You cash out some of your 401k or IRA early

- You claim large gambling losses or don’t report big winnings

These are some of the most common ways to get the IRS’s attention, but if you avoid these kinds of things you might reduce your chance of an audit.

However, there is no full-proof way to avoid an audit, but keep this in mind: as long as you are being honest on your taxes you don’t have anything to worry about. Even if you are selected for an audit you will come out unscathed if you have nothing to hide. Another thing that can help is to contact a professional tax preparer to do your taxes for you. This will decrease errors and your chances of being selected for an audit. Contact GROCO if you need help with your taxes. Call 1-877-CPA-2006, or click here.

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

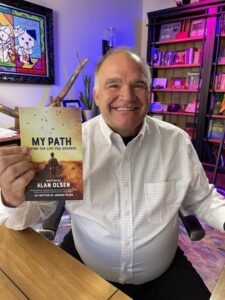

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…