Taxable Investment Account

Be Careful What You Put in Your Taxable Investment Account

By Kent Livingston

Mutual funds are a great option for anyone who wants to invest his or her money in the stock market but has limited time, money or knowledge. In short, mutual funds offer a simple way for just about anyone to play the market. Essentially, a mutual fund combines money from thousands of smaller investors into a large pool. The manager of that pool then buys stocks, bonds and/or other securities with that money. If you have contributed to the fund, then you get to claim a stake in all of that fund’s investments.

Choose Wisely

Mutual funds are a great way to be involved in the stock market without having to worry about tracking all of your individual holdings. However, as with any investment, you have to choose your mutual funds wisely. Even more importantly, you need to carefully choose in what kind of account you place them. If you put your mutual funds into the wrong kind of investment account, it could definitely come back to haunt you. So how do you know where to put them? Let’s take a look.

Retirement Account

Placing your mutual fund earnings in a tax-deferred retirement account is probably the best way to go. By having your funds in a 401K or IRA retirement plan you can avoid a potentially huge tax bill. However, if you have placed your mutual funds in some kind of taxable account then you could be feeling the pain come payout time.

Taxable Account

One type of investment account that is particularly bad for mutual funds is a has-been fund. This is a fund that used to have great returns but is now falling from grace. What happens is that investors begin to leave the fund, which means the fund needs new cash. That could mean that selling off old shares at rebated prices might be the only option. So what should you do to avoid this kind of scenario? Avoid buying any fund that includes a big number for “unrealized appreciation.”

Rules To Remember

There are some other important rules to remember for people who have mutual funds in taxable accounts. They are:

- Avoid high-turnover funds – short-term capital gains are not good for taxable funds. Therefore, you want to avoid funds that have high turnover rates. Short-term gains can be converted into “ordinary income,” which can be costly to your account.

- Selling might be the best option – sometimes the best option is to get out while you still can, instead of paying an even higher tax bill down the road.

- Buy index ETFs – Index funds are a good choice because they don’t redeem with cash. Instead, they are redeemable with more stock.

Don’t Let The IRS Take it All

No matter what kind of mutual funs or other investments funds you have, you need to always be aware of the tax laws that apply. That is where GROGO can help. Tax planning is one or our specialties, including stock options planning. Don’t let the IRS take more of your money than they should. We can help you plan your taxes the right way for each of your investments. Just give us a call at 1-877-CPA-2006, or click here.

We hope you found this article about “Taxable Investment Account” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

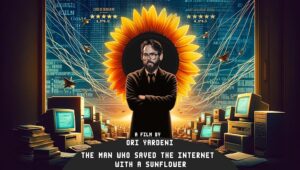

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…

Early Detection Saves Lives with Steve Marler

Steve Marler, Founder of Advanced Longevity discusses how early detection can save lives and overcoming a broken healthcare system on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Welcome to American Dreams. My guest today is Steve Marler. Steve, welcome to the show. Steve Marler Thank you. It’s great to be here. Alan Olsen So Steve,…