5 Powerful ESG, Business, and Investing Trends

Key ESG, Business, and Investing Trends.

What does the future hold for businesses navigating the complexities of sustainability and finance? A recent American Dreams Show interview by Host, Alan Olsen on behalf of Legacy Builder’s invitation only philanthropy events, of Michael Meehan, titled “The Future of ESG and Impact Investing with Michael Meehan“. The interview addressed 5 powerful ESG, business, and investing trends. Michael, Co-founder of Canoe Carbon and a seasoned expert in Environmental, Social, and Governance (ESG) finance and sustainable investment, offers profound insights and strategic guidance for today’s entrepreneurs and business leaders.

Michael’s extensive career, including roles as Chairman of the UK Sustainable Investment & Finance Association and CEO of the Global Reporting Initiative, places him at the forefront of thought leadership in sustainable finance.

ESG is a framework used by businesses, investors, and organizations to evaluate their impact and performance based on non-financial factors. The “Environmental” aspect focuses on how a company performs as a steward of nature, addressing issues such as climate change, resource depletion, and waste management. The “Social” component examines how a business manages relationships with employees, suppliers, customers, and the communities in which it operates, tackling matters like human rights, labor standards, and community engagement.

Lastly, “Governance” concerns a company’s leadership, board structure, executive pay, audits, internal controls, and shareholder rights, ensuring that ethical management standards are upheld. Deploying ESG criteria helps investors identify companies with values and practices that align with their own ethical or sustainability goals.

1 Key American Business Trends

During the conversation, Michael highlighted several emerging trends shaping the landscape of American business. He emphasized the growing integration of technology and sustainability, noting that companies that harness these dynamics are poised to thrive. “The intersection of tech and sustainability is where the future lies,” Michael stated, underscoring how businesses can leverage innovations to meet both environmental and market demands.

Challenges such as regulatory pressures and the need for transparency in supply chains is growing. However, Michael framed these as opportunities, encouraging businesses to innovate and adapt. “Regulation shouldn’t be seen as a hurdle; it’s a chance to lead and differentiate,” he advised.

2 Actionable Advice for Entrepreneurs and Business Leaders

Michael provided practical advice for those in the entrepreneurial and corporate sectors. He stressed the importance of agility and foresight, urging leaders to remain adaptable and proactive. “Stay ahead by constantly reassessing your strategy and being open to pivoting when necessary,” he recommended.

He also shared steps for success and innovation:

- Cultivate a strong vision that aligns with your core values and market needs.

- Invest in talent development to foster a culture of creativity and resilience.

- Engage with stakeholders openly to build trust and collaboration.

Data plays a critical role in informed decision-making. Start with a well-informed business plan. Leaders should leverage data analytics to gain deeper insights into consumer behavior and market trends. A Harvard Business Review article highlighting how companies utilizing data-driven strategies consistently outperform those that don’t. “In today’s digital age, real-time data can provide the competitive edge needed to stay ahead,” he emphasized. By embracing technology, leaders can tailor their offerings more effectively to meet the evolving demands of their customers.

Additionally, Michael urged leaders to prioritize ESG considerations in their business models. A report by McKinsey & Company supports his view, pointing out that companies integrating ESG principles often see enhanced long-term financial performance. He advised leaders to see ESG not just as a compliance requirement, but as an opportunity to innovate and capture new market segments. “Businesses that embed sustainability into their core operations are setting themselves up for sustainable success and relevance in the future,” he concluded, encouraging leaders to position their organizations as proactive change-makers in the industry.

3 The Power of Vision, Purpose, and Impact Investing

A recurring theme is the critical role of vision and purpose in business. Purpose-driven companies are not only more resilient but also more appealing to investors and consumers alike. “Purpose is the new currency in business,” organizations with a clear mission can drive meaningful change while achieving financial success.

Impact investing has evolved into a dynamic field that closely aligns financial returns with positive societal and environmental outcomes. By directing capital towards initiatives that address pressing global challenges, impact investors are reaffirming the notion that business can play a crucial role in creating a sustainable future. Organizations like the Global Impact Investing Network (GIIN) have been instrumental in shaping this market by providing resources and research that underscore the significance of aligning investments with social and environmental objectives. [Learn more about GIIN and their role in impact investing here](https://thegiin.org/).

Furthermore, the landscape of impact investing is rapidly expanding as investors recognize the potential for high returns when social and environmental impact is prioritized. Reports from think tanks such as the Brookings Institution illustrate how strategic impact investments can instigate market differentiation and foster innovation. As more businesses integrate sustainable practices, they are not only appealing to ethically-conscious consumers but also securing their position in the market against ever-evolving regulatory standards. Explore Brookings’ insights on impact investing in their comprehensive reports.

This aligns closely with the rise of socially conscious brands and the increasing demand for transparency and accountability in business practices. By integrating purpose into their operations, companies can forge stronger connections with their audience and create enduring value.

4 Navigating Economic Challenges

In the face of economic uncertainty, Michael offered insights into resilience and strategic planning. He stressed the importance of risk management and long-term thinking, advising businesses to diversify their portfolios and invest in sustainable practices. “Economic downturns test the mettle of a business, but those with clear strategies and adaptability will emerge stronger,” he shared.

Addressing economic challenges requires a blend of strategic foresight and practical resilience measures. Businesses need to assess their current financial health and identify potential risks that could impact their operations. Conducting regular financial audits and scenario planning can help in anticipating downturns and preparing effectively. Moreover, building a robust cash reserve, optimizing expenses, and seeking cost-effective solutions can provide a buffer during tough times. According to Harvard Business School, maintaining financial agility is crucial and allows organizations to pivot quickly in response to economic changes.

It’s essential for businesses to leverage technology and innovation to stay competitive during economic challenges. Digital transformation and investment in AI and automation can streamline operations, increase efficiency, and reduce costs. Additionally, companies may explore strategic partnerships and collaborations to diversify their offerings and reach new markets. A Deloitte report suggests that businesses adopting digital strategies tend to recover faster from economic shocks, as they are better equipped to adapt and innovate. Therefore, embracing a proactive approach with a focus on both immediate resilience and long-term growth is vital for navigating through uncertain economic landscapes.

Keywords such as “navigating economic downturn” and “strategic business planning” are particularly relevant in today’s volatile market.

5 Predictions and Future Outlook

Looking ahead, Michael shared his predictions for the future of business and industry trends. He foresees continued growth in sustainable finance and the integration of AI and data analytics in decision-making processes. “The future of business is digital, data-driven, and sustainable,” he predicted, highlighting the need for companies to adopt innovative technologies to remain competitive.

These future-oriented insights provide a roadmap for entrepreneurs and business leaders seeking to stay ahead in a rapidly evolving landscape.

Michael’s emphasis on the convergence of technology and sustainability is echoed by recent studies and reports from leading institutions. According to a report by the World Economic Forum, the integration of advanced technologies such as AI and the Internet of Things (IoT) can significantly enhance sustainable business practices [The Future of Sustainability: Shaping Technology for Sustainability](https://www.weforum.org/reports/the-future-of-sustainability-shaping-technology-for-global-goals).

Furthermore, the notion that regulation can serve as a catalyst for innovation is supported by research from the Harvard Business Review, which indicates that forward-thinking companies see regulation as an opportunity to innovate rather than a constraint [Regulation Isn’t a Burden — It’s an Opportunity](https://hbr.org/2021/07/regulation-isnt-a-burden-its-an-opportunity).

Michael’s advocacy for purpose-driven businesses aligns with findings from Deloitte’s Global Millennial Survey, which highlights that consumers, especially younger generations, increasingly favor companies with strong ethical and social purpose [Millennials and Gen Z value purpose over the bottom line](https://www2.deloitte.com/global/en/pages/about-deloitte/articles/millennialsurvey.html).

These resources offer added depth and corroborate Michael Meehan’s insights, providing business leaders with additional perspectives to consider as they formulate their strategies. Overall, Michael’s perspectives and advice serve as a valuable resource for entrepreneurs and business leaders seeking to navigate the intersection of sustainability and finance successfully. His emphasis on foresight, innovation, and purpose provides crucial guidance for businesses looking to drive positive change while achieving financial success. So, it is essential for businesses to integrate sustainable practices into their operations to stay relevant in a rapidly evolving market.

Learn from other Successful Entrepreneurs

From one of the most famous entrepreneur, Henry Ford, to the youngster manning their lemonade stand, the entrepreneurial spirit is often fueled by the drive to innovate and the ambition to transform ideas into reality. Aspiring entrepreneurs frequently look up to the greatest entrepreneurs who have turned their visions into thriving enterprises. These trailblazers, like many other famous entrepreneurs, exemplify how perseverance, creativity, and a willingness to take calculated risks can lead to huge success.

Many of the most successful tech companies in today’s market were born from the relentless pursuit of innovation and the ability to overcome challenges. These stories serve as powerful examples for those pursuing to build their own business, reminding them that success is achievable with dedication and ingenuity.

For most entrepreneurs, the journey begins with investing their own money and all the skill they can muster to see their visions come to life. While owning a business comes with its share of risks, it also offers unparalleled opportunities for growth and fulfillment. Entrepreneurs who have successfully built their own businesses often emphasize the importance of adaptability and a clear understanding of market needs. By learning from established leaders and continuously refining their strategies, aspiring entrepreneurs can enhance their ability to navigate the complex landscape of the business world.

Ultimately, the most rewarding entrepreneurial endeavors are those that not only achieve financial success but also leave a significant and positive impact on the industry and community.

Most Successful Entrepreneurs

When examining the world’s wealthiest people, many share a common thread of having overcome numerous setbacks on their path to success. Thomas Edison, for instance, is famously quoted as saying, “I have not failed. I’ve just found 10,000 ways that won’t work,” reflecting his relentless pursuit of innovation despite facing repeated failures. This mindset is echoed in the journeys of numerous American business magnates. Steve Jobs, co-founder of the Apple Computer Company, is a prime example. His visionary leadership as chief technology officer and later his return to Apple revolutionized the technology industry, showcasing how perseverance and innovation are critical components of sustained success.

Meanwhile, in the business world, not all journeys result in triumph. A significant number of small businesses fail, often due to a lack of strategic planning and adaptability. This harsh reality underscores the importance of learning from industry leaders. Figures such as Bill Gates of Microsoft Corporation highlight the necessity of marrying innovation with sound business strategies. Similarly, for those in the media company sector, understanding market dynamics and changing consumer preferences becomes essential to achieve and maintain success.

By studying both the triumphs and failures of these influential figures, aspiring entrepreneurs can better navigate the complex business landscape and turn challenges into stepping stones toward their own achievements.

More advice on how to be a successful entrepreneur?

Launching a successful business venture is a monumental achievement that many aspire to but few accomplish. The Ford Motor Company wasn’t born overnight, but Henry Ford had a clear vision of his path to success and achieved it step by step. Overcoming obstacle after obstacle from having to create a market/demand, to facing a new Detroit automobile company every couple of years. All of which benefitted from his bleeding edge position. Your own entrepreneurial journey should involve not only a clear vision and strategic planning but also unwavering determination and resilience.

From crafting a comprehensive business plan to executing the strategy flawlessly, the path to success is laden with challenges. However, for many entrepreneurs, this journey often starts with their first business venture, a critical stepping stone that paves the way for future endeavors. This initial experience provides invaluable insights and practical knowledge that can be applied to subsequent ventures. business plan

Your Own Business

Owning your own company offers an unparalleled sense of autonomy and creative freedom. It allows entrepreneurs to bring their unique visions to life and make impactful decisions that shape the direction of their business. The ability to mold company culture, respond swiftly to market changes, and innovate without constraints is a powerful motivator. Yet, being the only person at the helm requires balancing numerous responsibilities and overcoming unforeseen obstacles. Successful businesses often result from an entrepreneur’s ability to multitask, delegate effectively, and maintain a strategic focus on their long-term objectives, all while managing existing and bringing in new business.

For aspiring entrepreneurs, the pursuit of business opportunities is a continuous endeavor that requires openness to learning and adaptation. Many of the greatest entrepreneurs have embarked on their own entrepreneurial journey by identifying gaps in the market and developing innovative solutions to address them. They understand that entrepreneurial success stems from a blend of creativity, market awareness, and robust execution. By continuously seeking knowledge and refining their skills, entrepreneurs can ensure their ventures remain viable and competitive in the ever-evolving business landscape.

In this dynamic environment, annual sales become a key metric of success for any business. They reflect the culmination of a company’s strategic efforts and its ability to resonate with customers. Entrepreneurs often measure their achievements not just by financial metrics but also by the legacy they create within their industry. Those who embark on entrepreneurial endeavors with a focus on long-term value creation are more likely to see sustained success and fulfillment. This blend of practicality and purpose drives the most enduring and impactful business accomplishments.

A Chief Executive Officer (CEO) plays a pivotal role in the success of any business venture. Acting as the visionary leader and the company’s public face, the CEO is responsible for setting the tone and direction of the organization. In the current fast-paced world of information technology, CEOs must navigate complex challenges and drive innovation to keep their companies relevant and competitive. Take the case of tech giant companies, where the CEO must balance strategic growth opportunities with maintaining the core values and culture of the parent company. Successful CEOs often leverage their early life experiences and insights gained over their careers to make impactful decisions that propel their enterprises forward.

For entrepreneurs aspiring to start their own business, understanding the roles and responsibilities of a Chief Executive Officer is crucial. While the title may initially seem synonymous with success, being a CEO, similar to a managing director, requires an exceptional ability to manage teams, resources, and strategies. In sectors like the boring company industry, where innovation is a key differentiator, the CEO must foster an environment that encourages creativity while ensuring financial sustainability.

The entrepreneurial journey is inherently challenging and requires a strong leadership presence to guide the company through both prosperous and difficult times. By studying successful CEOs, entrepreneurs can glean invaluable lessons on steering their own ventures toward sustainable growth and industry leadership.

Michael Meehan’s expertise offers invaluable guidance for those navigating the complex intersection of sustainability and finance. His insights into emerging business trends, the power of vision, and strategies for overcoming economic challenges equip leaders with the tools needed to thrive in the modern business world.

For those eager to explore sustainable finance further, consider joining the dialogue at the Forum for Impact or connecting with experts like Michael to deepen your understanding and drive meaningful change in your organization. And may your entrepreneur endeavors be successful.

To view more content like this, click here to subscribe to our YouTube channel

And click here to receive our FREE Newsletter.

More about Michael Meehan:

With over 20 years of experience in ESG finance, sustainability, and impact, Michael is a senior advisor and thought leader to funds, companies, investors and governments around the world. He is the former Chairman of the UK Sustainable Investment & Finance Association, a consortium of leading institutional investors with AUM of over £11 trillion, and sits on the advisory boards for funds in the EU, US, Canada and Asia. Michael is the co-founder of Forum for Impact, a consortium of investors and family office principals that promote a global dialogue on impact and sustainable investment. He is the CEO of Canoe Carbon, and former CEO of the Global Reporting Initiative (GRI), the largest sustainability standard in the world.

Previously, Michael has also served as vice chair of the Natural Capital Coalition, CEO of Carbonetworks, and is adjunct professor of Sustainable Finance for Gustavson School of Business at the University of Victoria, Canada. Throughout his career, Michael has worked with the White House, the UN, the World Economic Forum, and many other organizations in his mission to improve the state of the world through sustainable finance.

Additional References:

-

- The Future of Sustainability: Shaping Technology for Sustainability by World Economic Forum

- Regulation Isn’t a Burden — It’s an Opportunity by Harvard Business Review

- Millennials and Gen Z value purpose over the bottom line by Deloitte’s Global Millennial Survey So, it is essential for businesses to integrate sustainable practices into their operations to stay relevant in a rapidly evolving market.

- Regulation Isn’t a Burden — It’s an Opportunity by Harvard Business Review

- The Future of Sustainability: Shaping Technology for Sustainability by World Economic Forum

Unveiling Entrepreneurial Success with Randi Brill

Randi Brill, best-selling author and CCO of Just Call Randi Design Agency discusses unveiling entrepreneurial success on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Randy brill. Ready welcome to today’s show. Randi Brill Thank you, Alan. I’m glad to be here. …

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

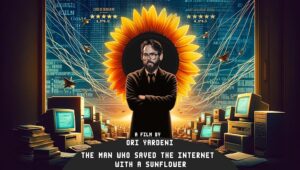

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…