Business in New York Being Buried by Heavy Tax Load

New York, New York: It’s the town so nice they named it twice. But when it comes to taxes in one of the world’s greatest states, things aren’t so nice. That’s because New York is one of the worst places to live if you don’t want to pay a lot of taxes.

New York has some of the highest tax rates on income, whether it’s personal or business, in the country. The high taxes don’t stop there, either. New York also has some of the highest property taxes, as well. In fact, according to the Tax Foundation New York has the nation’s highest tax burden and the second highest all-in top tax income.

The bad news doesn’t stop there for New Yorkers, as the state is also has the highest local and state corporate tax rate in the country, as well as the country’s seventh highest property tax figure. New York also has the fifth highest workers’ compensation cost and to top it all off New York even gets you in the afterlife with its death tax.

The effects of these taxes are notable. Thanks to its never-ending tax burden, New York has lost more money in income from people and businesses moving out of the state than any other state in America. The numbers are staggering. Between 1993 and 2010, New York lost more than $67 billion in yearly income to other states, along with more than a million taxpayers over that same time period.

The bottom line, if you live, work or own a business in New York, then you won’t be getting any favors at tax time.

Investing with Style

Investing with Style How do you define your approach to investing? There may be many answers to that question. One answer goes to the style of investing that you choose: value or growth. Are you looking for value? The goal of a value investor is to seek out “bargains,” finding those companies whose stock may…

Introducing the “Total Return” Trust

Introducing the “Total Return” Trust The fundamental purpose of most trusts is to create a plan of financial protection for more than one beneficiary, often beneficiaries in different generations. “All the trust income to my surviving spouse, with the balance to be divided among our children at her death” might be used in a marital…

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

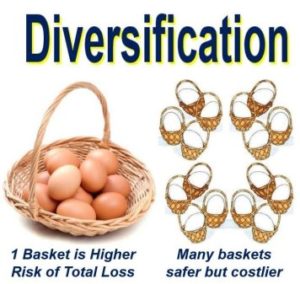

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…