Could These Tax Deductions Save You Big?

Could These Tax Deductions Save You Big?

It’s tax time. Of course, you know that already, unless you’ve been hiding under a rock for the last several weeks. Tax time means refund time, right? Not for everyone, but in most cases, yes. But so far this year, refunds are down and many taxpayers have been caught off guard. One of the biggest factors to getting a large refund, or a refund period, is claiming every tax deduction you can possibly use.

But even deductions can’t help everyone. The new standard deduction has increased to $24,000 for married couples filing jointly and to $12,000 for single filers. Because of that, most people won’t itemize their deductions this year. That being said, there are some deductions you can claim even if you don’t itemize.

Don’t Forget Your Student Loans

For example, do you have student loans? You can claim your student loan interest as a deduction, even if you choose the standard deduction option and skip the itemizing. You have to meet a few requirements, but if you do, this is a good way to reduce your taxable income. In fact, you can claim up to $2,500 in interest paid on qualified student loans.

However, you must be paying interest on the loan and it must be for you, a dependent child, or your spouse. You also must be legally obligated to pay off the loan and you must be making payments. One more thing to remember, the more money you make the amount of interest you can deduct begins to phase out. If you’re single it starts as soon as you begin making $60,000. The phase out income for married couples filing jointly is $125,000.

Mortgage Interest Deduction

Unfortunately, you can only deduct your mortgage interest if you itemize. So for many, this won’t be worth it. However, for those who have large mortgages, it might make itemizing worth it. It will depend on whether or not you have enough total deductions to surpass the standard deduction amounts.

Self-Employment Social Security Tax

This is another deduction you can take, whether or not you itemize. If you’re self-employed you have to pay the entire 12.4 percent tax for Social Security, instead of splitting it with an employer. That’s the bad news. The good news is you can deduct half of this amount as an income tax deduction. Depending on your total income that could equal a significant reduction on your taxable income.

Licensing Fees and Professional Dues

These deductions are no longer available for the 2018 tax year. However, if you paid any dues or fees before 2018 that you still haven’t claimed, you can claim them now. For example, any licensing fees you have to pay to stay accredited, or any dues you must pay to retain memberships or licenses, can be deducted from your 2018 taxable income. Make sure you’re employer didn’t already reimburse you for any of these fees or dues. If they have then you can’t claim them as a deduction.

At GROCO, we make sure you get credit for every deduction possible. You work hard for your money and we help you keep as much of it as legally possible.

We hope you found this article about “Could These Tax Deductions Save You Big?” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Brian Smedley – Chief Economist at Guggenheim Investments

The Economic Forecaster – Brian Smedley Droves of anxious people take to the arid streets of Tatooine. The desert planet recently experienced a decline in GDP and now with inflation on the rise, rash financial decisions made by the population were a real danger. As the crowd continues onward, it is confronted by a stranger.…

10 Steps for TikTok Marketing

With over 500 million active users, TikTok is a social media powerhouse that you can’t afford to ignore. Here are 10 steps for marketing your business on TikTok. 1. Research your audience: Who are you trying to reach with your TikTok marketing? What are their demographics? What type of content do they consume and engage…

Business Valuation Terms Explained “DLOCK” Vs “MID”

The Discount for Lack of Control (DLOC) vs. The Minority Interest Discount (MID) The Business Valuation Glossary provides these definitions of two similar terms: Discount for Lack of Control – an amount or percentage deducted from the pro rata share of value of 100% of an equity interest in a business to reflect the absence…

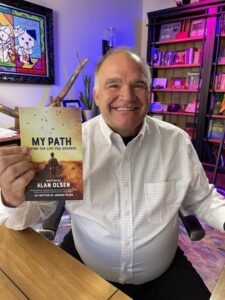

The “My Path” Book is now available on Amazon!

Dear American Dreams Show Subscribers, “My Path” is now available on Amazon! We are excited and proud to announce that after a decade of interviewing some of the most interesting and successful business and thought leaders in the world, the American Dreams Show’s Host, Alan Olsen, has published the first book based on a…