Incoming House Democrats Win First Tax Battle

Incoming House Democrats Win First Tax Battle

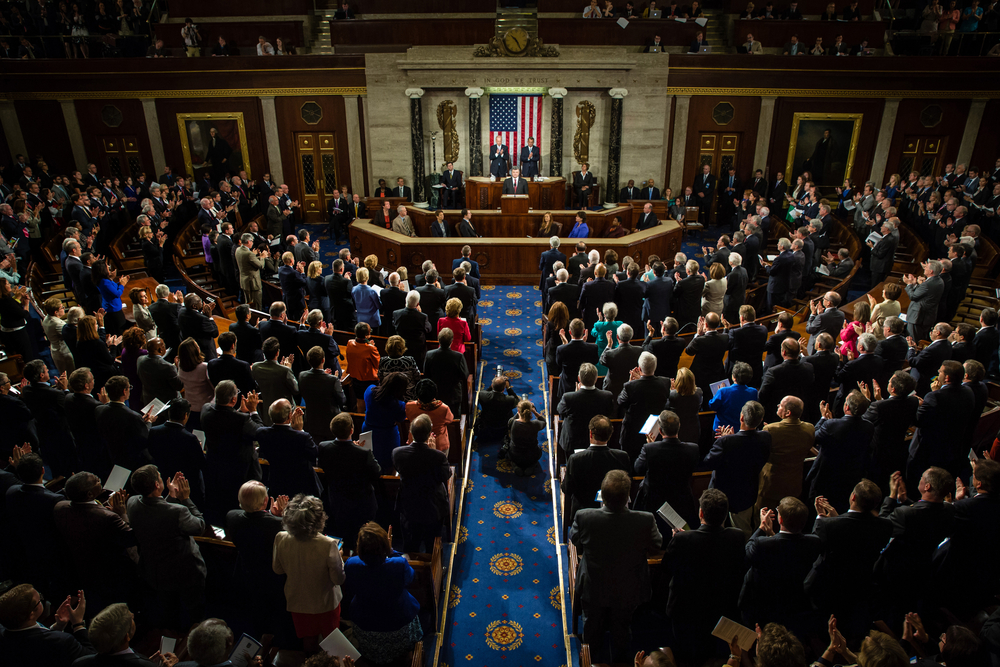

The calendar year has not yet changed, which means newly elected members of the House and Senate have yet to officially take their seats in the Nation’s Capitol. However, House democrats are already busy making changes in preparation for the new year.

And one of their top priorities is raising taxes. Newly elected democrats are taking aim at the tax Cut and Jobs Act. And they’ve taken a big first step in their goal to raise taxes, especially on the wealthy.

The Washington Post reported that the incoming chairman of the House Rules Committee, Rep. Jim McGovern (D., Mass.), confirmed last week that he would not honor the three-fifths super majority requirement to raise income taxes.

That decision will overturn the previous rule put in place by the outgoing Speaker of the House, Paul Ryan (R., Wis.). That rule made it impossible to raise income tax without a three-fifths majority approval.

The change could make it easier for House democrats to pass new proposals ultimately designed to raise taxes on the wealthy. The decision comes after pressure from newer, more progressive democrats, who want to create more revenue to fund things like universal health care and free college tuition.

Republicans were quick to attack the announcement, saying democrats could use the change to raise taxes on the middle class.

We hope you found this article about “Incoming House Democrats Win First Tax Battle” helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Alan Olsen, is the Host of the American Dreams Show and the Managing Partner of GROCO.com. GROCO is a premier family office and tax advisory firm located in the San Francisco Bay area serving clients all over the world.

Alan L. Olsen, CPA, Wikipedia Bio

GROCO.com is a proud sponsor of The American Dreams Show.

The American Dreams show was the brainchild of Alan Olsen, CPA, MBA. It was originally created to fill a specific need; often inexperienced entrepreneurs lacked basic information about raising capital and how to successfully start a business.

Alan sincerely wanted to respond to the many requests from aspiring entrepreneurs asking for the information and introductions they needed. But he had to find a way to help in which his venture capital clients and friends would not mind.

The American Dreams show became the solution, first as a radio show and now with YouTube videos as well. Always respectful of interview guest’s time, he’s able to give access to individuals information and inspiration previously inaccessible to the first-time entrepreneurs who need it most.

They can listen to venture capitalists and successful business people explain first-hand, how they got to where they are, how to start a company, how to overcome challenges, how they see the future evolving, opportunities, work-life balance and so much more..

American Dreams discusses many topics from some of the world’s most successful individuals about their secrets to life’s success. Topics from guest have included:

Creating purpose in life / Building a foundation for their life / Solving problems / Finding fulfillment through philanthropy and service / Becoming self-reliant / Enhancing effective leadership / Balancing family and work…

MyPaths.com (Also sponsored by GROCO) provides free access to content and world-class entrepreneurs, influencers and thought leaders’ personal success stories. To help you find your path in life to true, sustainable success & happiness. It’s mission statement:

In an increasingly complex and difficult world, we hope to help you find your personal path in life and build a strong foundation by learning how others found success and happiness. True and sustainable success and happiness are different for each one of us but possible, often despite significant challenges.

Our mission at MyPaths.com is to provide resources and firsthand accounts of how others found their paths in life, so you can do the same.

Alternative to Deleting Facebook

Facebook is getting a lot of criticism. Last week Apple CEO Tim Cook slam’s Facebook that it wouldn’t be in the situation because it cares about privacy. Facebook is also getting heat from congress over the last presidential election and the spreading of fake news.While some users are calling to delete their Facebook account, there are other options. According to Mark Zuckerburg, Facebook is taking actions to prevent companies from getting your information and ensuring these types of things

How to Maintain the Most Important Ingredient for Leadership

Remember those battery commercials featuring the Energizer Bunny? He just kept going, and going, and going. Yes, it’s true. That Bunny might have been a little annoying, but the message was clear. Energy is important and you never want to run out of it. So what about energy in the business world? How important is energy to an organization’s success? The truth is it’s vital.Energy Breeds SuccessHave you ever worked for a company that was low on energy? Going to work was probably a drag. There is

Beware of Cryptocurrency Frauds

Does it seem like a new cryptocurrency is born each day? Digital coins are popping up continuously, with each hoping to be the next Bitcoin. While most cryptocurrencies will likely never reach the value of Bitcoin, some of them have no intention to. That’s because scammers are becoming more prevalent all the time in the cryptocurrency market.If you haven’t been paying attention, several agencies are starting to sound alarms. According to recent reports, The U.S. Commodity Futures Trading

When Is a Good Time to Get Into the Stock Market Game?

Anyone who has ever studied or even followed the stock market knows that market ebbs and flows. There will always be ups, and there will always be downs. That’s simply the nature of investing. If it were easy to predict then everyone would be successful and wildly wealthy.Last year saw amazing gains in the stock market, as a whole. However, this year, things have been heading in the other direction. Just last month the market saw some big dips, including a one-day loss on the Dow Jones of more