PPP FAQs (Paycheck Protection Act Frequently Asked Questions)

PPP FAQs (Paycheck Protection Act Frequently Asked Questions)

PPP FAQs (Paycheck Protection Act Frequently Asked Questions). Since the announcement of the Coronavirus Aid, Relief, and Economic Security ACT (CARES Act), it has sparked both interest and confusion amongst all those considering taking advantage of its benefits. Particularly the Paycheck Protection program, or PPP. In an effort to reduce confusion, the IRS has posted several FAQs with answers on its official website. We have taken the liberty of selecting a few of these questions and answers, most from an April 6, 2020 release, to share with our friends and clients. Our hope is to help others better understand issues that require additional “official” clarification. For more information please visit our GROCO.com COVID-19 Resource Center.

As is typical of governmental agencies, the clarifications are given, but with an unfortunate caveat at the bottom of the page; “This document does not carry the force and effect of law independent of the statute and regulations on which it is based.” However, the document goes on to clearly explain a few issues many tax professionals and potential participants absolutely need.

The Small Business Administration (SBA), in consultation with the Department of the Treasury, intends to provide timely additional guidance to address borrower and lender questions concerning the implementation of the PPP, established by section 1102 of the CARES Act. Their FAQ page is intended to be updated on a regular basis.

Borrowers and lenders may rely on the guidance provided in this document as SBA’s interpretation of the CARES Act and of the PPP Interim Final Rule (“PPP Interim Final Rule”). You’ve got to love the government, who else could use the phrase “interim final rule” with a straight face? The U.S. government will not challenge lender PPP actions that conform to this guidance, and to the PPP Interim Final Rule and any subsequent rulemaking in effect at the time.

From IRS Q&A (4/6/2020) seeks to clarify these issue:

Question 16: How should a borrower account for federal taxes when determining its payroll costs for purposes of the maximum loan amount, allowable uses of a PPP loan, and the amount of a loan that may be forgiven?

Answer: Under the Act, payroll costs are calculated on a gross basis without regard to (i.e., not including subtractions or additions based on) federal taxes imposed or withheld, such as the employee’s and employer’s share of Federal Insurance Contributions Act (FICA) and income taxes required to be withheld from employees. As a result, payroll costs are not reduced by taxes imposed on an employee and required to be withheld by the employer, but payroll costs do not include the employer’s share of payroll tax. For example, an employee who earned $4,000 per month in gross wages, from which $500 in federal taxes was withheld, would count as $4,000 in payroll costs. The employee would receive $3,500, and $500 would be paid to the federal government. However, the employer-side federal payroll taxes imposed on the $4,000 in wages are excluded from payroll costs under the statute.

The associated tax law for question #16: The definition of “payroll costs” in the CARES Act, 15 U.S.C. 636(a)(36)(A)(viii), excludes “taxes imposed or withheld under chapters 21, 22, or 24 of the Internal Revenue Code of 1986 during the covered period,” defined as February 15, 2020, to June 30, 2020. As described above, the SBA interprets this statutory exclusion to mean that payroll costs are calculated on a gross basis, without subtracting federal taxes that are imposed on the employee or withheld from employee wages. Unlike employer-side payroll taxes, such employee-side taxes are ordinarily expressed as a reduction in employee take-home pay; their exclusion from the definition of payroll costs means payroll costs should not be reduced based on taxes imposed on the employee or withheld from employee wages.

This interpretation is consistent with the text of the statute and advances the legislative purpose of ensuring workers remain paid and employed. Further, because the reference period for determining a borrower’s maximum loan amount will largely or entirely precede the period from February 15, 2020, to June 30, 2020, and the period during which borrowers will be subject to the restrictions on allowable uses of the loans may extend beyond that period, for purposes of the determination of allowable uses of loans and the amount of loan forgiveness, this statutory exclusion will apply with respect to such taxes imposed or withheld at any time, not only during such period.

Question 2: Are small business concerns (as defined in section 3 of the Small Business Act, 15 U.S.C. 632) required to have 500 or fewer employees to be eligible borrowers in the PPP?

Answer: No. Small business concerns can be eligible borrowers even if they have more than 500 employees, as long as they satisfy the existing statutory and regulatory definition of a “small business concern” under section 3 of the Small Business Act, 15 U.S.C. 632. A business can qualify if it meets the SBA employee-based or revenue – based size standard corresponding to its primary industry. Go to www.sba.gov/size for the industry size standards. Additionally, a business can qualify for the Paycheck Protection Program as a small business concern if it met both tests in SBA’s “alternative size standard” as of March 27, 2020: (1) maximum tangible net worth of the business is not more than $15 million; and (2) the average net income after Federal income taxes (excluding any carry-over losses) of the business for the two full fiscal years before the date of the application is not more than $5 million. A business that qualifies as a small business concern under section 3 of the Small Business Act, 15 U.S.C. 632, may truthfully attest to its eligibility.

Question 7: The CARES Act excludes from the definition of payroll costs any employee compensation in excess of an annual salary of $100,000. Does that exclusion apply to all employee benefits of monetary value?

Answer: No. The exclusion of compensation in excess of $100,000 annually applies only to cash compensation, not to non-cash benefits, including: · employer contributions to defined-benefit or defined-contribution retirement plans; · payment for the provision of employee benefits consisting of group health care coverage, including insurance premiums; and · payment of state and local taxes assessed on compensation of employees.

Question 8: Do PPP loans cover paid sick leave?

Answer: Yes. PPP loans covers payroll costs, including costs for employee vacation, parental, family, medical, and sick leave. However, the CARES Act excludes qualified sick and family leave wages for which a credit is allowed under sections 7001 and 7003 of the Families First Coronavirus Response Act (Public Law 116–127). Learn more about the Paid Sick Leave Refundable Credit here.

Question 13: Are lenders permitted to use their own online portals and an electronic form that they create to collect the same information and certifications as in the Borrower Application Form, in order to complete implementation of their online portals?

Answer: Yes. Lenders may use their own online systems and a form they establish that asks for the same information (using the same language) as the Borrower Application Form. Lenders are still required to send the data to SBA using SBA’s interface.

Question 15: Should payments that an eligible borrower made to an independent contractor or sole proprietor be included in calculations of the eligible borrower’s payroll costs?

Answer: No. Any amounts that an eligible borrower has paid to an independent contractor or sole proprietor should be excluded from the eligible business’s payroll costs. However, an independent contractor or sole proprietor will itself be eligible for a loan under the PPP, if it satisfies the applicable requirements.

Question 17: I filed or approved a loan application based on the version of the PPP Interim Final Rule published on April 2, 2020. Do I need to take any action based on the updated guidance in these FAQs?

Answer: No. Borrowers and lenders may rely on the laws, rules, and guidance available at the time of the relevant application. However, borrowers whose previously submitted loan applications have not yet been processed may revise their applications based on clarifications reflected in these FAQs.

We sincerely hope you find these PPP FAQs (Paycheck Protection Act Frequently Asked Questions) answers helpful. If you have questions or need expert tax or family office advice that’s refreshingly objective (we never sell investments), please contact us or visit our Family office page or our website at www.GROCO.com. Unfortunately, we no longer give advice to other tax professionals gratis.

To receive our free newsletter, contact us here.

Subscribe to our YouTube Channel for more updates.

Considerately yours,

GROCO, GROCO Tax, GROCO Technology, GROCO Advisory Services, GROCO Consulting Services, GROCO Relationship Services, GROCO Consulting/Advisory Services, GROCO Family Office Wealth, and GROCO Family Office Services.

Unveiling Entrepreneurial Success with Randi Brill

Randi Brill, best-selling author and CCO of Just Call Randi Design Agency discusses unveiling entrepreneurial success on Alan Olsen‘s American Dreams Show. Transcript: Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Randy brill. Ready welcome to today’s show. Randi Brill Thank you, Alan. I’m glad to be here. …

Legacy Builders Philanthropic Revolution

Legacy Builders Conference Inspires Philanthropic Revolution The recent “Legacy Builders” event has sparked a philanthropic revolution, inspiring attendees to leverage their accumulated wealth for world betterment. The event, held on May 15, 2024, in San Jose, CA, featured distinguished speakers including NFL legend and HGGC Partner Steve Young¹, retired three-star General Michael Barbero², and Becky…

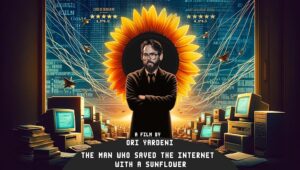

Rob Ryan’s Amazing Movie Premiere June 28th on How He Saved the Internet

The Hollywood movie premiere of the Rob Ryan story is a cinematic tribute to innovation. This remarkable film documents the real-life journey of this visionary from crisis to triumph and how he saved the internet! On June 28th at 9:30 PM in the iconic TCL Chinese Theatre. For tickets, click here. Rob Ryan, Founder…