Could You Lose Health Care if You Don’t File a Tax Return?

There’s been no shortage of confusion since the Affordable Healthcare Act became a law. Likewise, there has been no shortage of discontent with the bill, either. Obamacare, as it is widely known, continues to find ways to leave people in the dark not only about their healthcare, but also about their taxes. So what’s the latest issue surrounding Obamacare?

It turns out that some people, who would normally not be required to file a tax return, may actually need to file a return, after all; that is if they want to keep receiving their health care tax credit subsidies. That’s true, according to the new health care law, even if you would normally be exempt from filing a return.

The White House and the IRS are hopeful that the nearly 1.8 million U.S. households that received those tax credit subsidies to help pay their insurance premiums that haven’t yet filed will be asking for an extension very soon. While the monthly average tax credit was only about $270, with nearly nine million taxpayers taking advantage of those credits that is a lot of money to be giving up for next year. Add it all up and it totals about $28.4 billion.

The IRS is reportedly attempting to alert those who might still need to file a return. Therefore, if you receive a letter from the IRS regarding Obamacare make sure you give it a good reading. Of course, you should never throw any letter from the IRS away without reading it first. And if you get any kind of letter from the IRS that you’re not sure about, you can always contact our office at 1-877-CPA-2006.

Making Tax-wise Investments

Making Tax-wise Investments Tax considerations are not, and should never be, the be-all and end-all of investment decisions. The choice of assets in which to invest, and the way in which you apportion your portfolio among them, almost certainly will prove to be far more important to your ultimate results than the tax rate that…

Reducing Risk With a Diversified Portfolio

Reducing Risk With a Diversified Portfolio Have you been worried about the stock market’s recent volatility? You’re not alone. The stock market in March was a roller-coaster ride that served as a reminder to investors that the market’s ups and downs can be a little dizzying. But a volatile market should not leave you feeling…

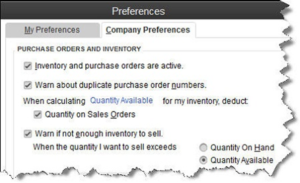

Are You Defining Items in QuickBooks Correctly?

[vc_row][vc_column][vc_column_text] Create item records in QuickBooks carefully, and QuickBooks will return the favor by running useful, accurate reports. Figure 1: Clearly-defined items result in precise reports. Obviously, you’re using QuickBooks because you buy and/or sell products and/or services. You want to know at least weekly — if not daily — what’s selling and what’s…

Saving Money for College: Education Credits

Saving Money for College: Education Credits Education credits are tax credits available for qualified education expenses paid by the taxpayer in the furthering of their education. Qualified education expenses are defined as an expense paid during the tax year for tuition and fees required by an eligible educational institution for student enrollment and attendance. Room…