How Each Presidential Candidate Plans to Handle Corporate Taxes

If you follow this blog then you know that corporate taxes are a regular topic discussed in this space. A couple weeks ago we shared some comments from Disney Chief Bob Iger regarding the country’s corporate tax policies. This is a topic that continues to get a lot of airtime in the media as the three candidates still running for president continue to push the issue.

One of the reasons this continues to be front and center is that income from corporate taxes keeps falling. While it still remains a huge source of revenue for the government, over the past several decades that revenue has been declining sharply. In fact, whereas in the 1950s corporate taxes accounted for 30 percent of the country’s tax revenue, in the year 2015 corporate taxes accounted for a mere 11 percent of the total tax base.

There are several reasons for the decline, including corporate tax breaks, a lower corporate tax rate, more profits coming overseas and many loopholes that allow corporations to cut their tax bills legally.

As mentioned, each of the three remaining candidates running for the nation’s top office have their own ideas on how to solve the problem and just as one would expect they differ greatly. In a nutshell, republican Donald Trump wants to cut the corporate tax rate down from 35 percent to 15 percent.

Hilary Clinton, on the other hand wants to close loopholes so corporations can’t avoid their taxes, which increase corporate tax revenues for the government substantially. At the same time she has not made any proposal to cut the corporate tax rate. Bernie Sanders wants to increase the corporate tax revenue by increasing the tax rate even higher and by taxing overseas profits, among other things.

Time will tell who wins the election, and when that person does, whether or not he or she will be able to implement his or her plan.

http://www.reuters.com/article/us-usa-election-taxes-idUSKCN0YS0C7

How to Successfully Sell Your Company

How to Successfully Sell Your Company Tips for Privately-Held Business Owners By Jason Pfannenstiel Be clear about your motivation for selling. Reason for the sale is among the first questions buyers will ask. Your personal and professional reasons should be more than simply wanting to cash out for a certain magical dollar value. Before you…

15 Ways to Improve Your Cash Flow Now

15 Ways to Improve Your Cash Flow Now By Howard Fletcher Cash management theory and techniques are well understood and practiced by treasury managers in large corporations. They use sophisticated models and cash management tools that allow them to predict and manage cash. Many of these are beyond the reach or need of small companies.…

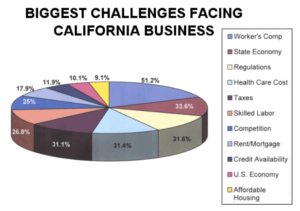

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…