How Will the New President Change Taxes for the Wealthy?

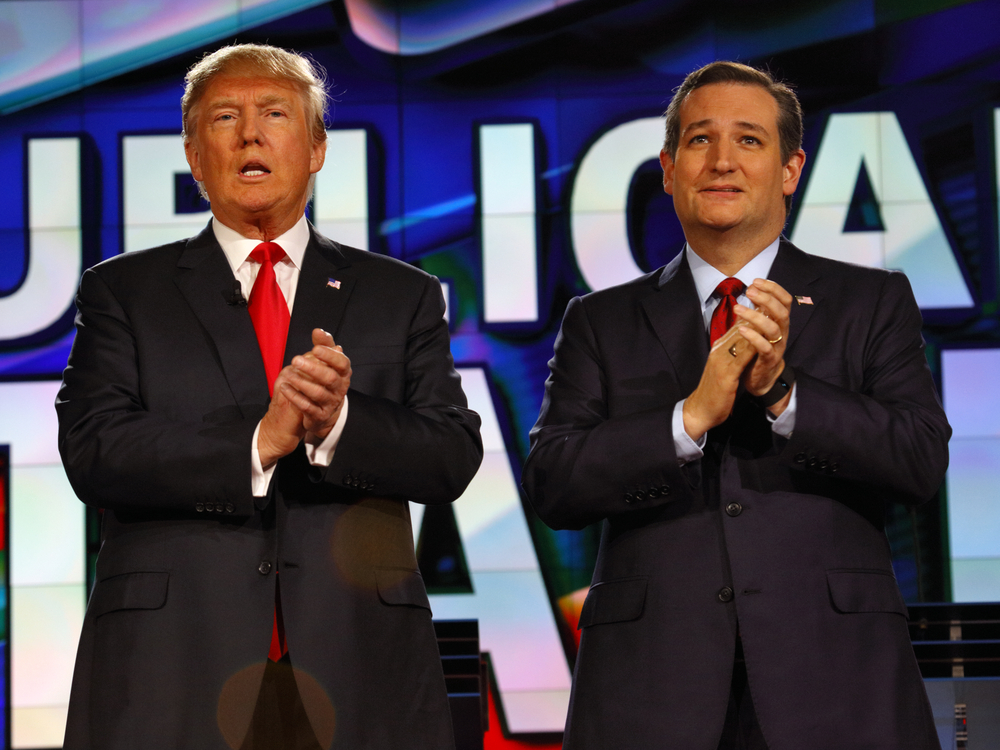

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

Family Businesses, Pamela Kan, President of Bishop-Wisecarver Corporation

Pamela Kan, CEO, Bishop-Wisecarver Corp. talks with the American Dreams show host, Alan Olsen, about family business and succession. Alan Olsen Hi, this is Alan Olsen and welcome to American Dreams. My guest today is Pamela Khan. She’s the president and owner of Bishop wise Carver. Welcome to today’s show. Pamela Kan Good morning, Alan.…

Using Your Money for Positive Change with Founder of Stickney Research

Using Your Money for Positive Change, with Founder of Stickney Research Warren Stickney is the founder and principal of Stickney Research, a firm that specializes in the design and implementation of net income makeup charitable remainder trusts (NIMCRT). In this interview, he discusses his passion on how to use your money for positive change in…

Committing to Humanity is So Important

Heidi Kuhn – Founder of Roots of Peace Heidi Kuhn is passionate about humanitarian work and has dedicated her life to making a difference in the world. As the founder of Roots of Peace, a humanitarian-nonprofit organization that is working to replace the scourge of landmines with sustainable agricultural farmland, Heidi, via Roots of Peace,…

The Evolution of Business Education

The Evolution of Business Education Dr. Jason Earl, Director for the Willes Center for International Entrepreneurship at BYU-Hawaii Dr. Jason Earl Transcript: Alan Can you share a little about your background? Jason I started down the path of engineering, ended up in corporate finance, ran a startup company, which sold to a private equity…