How Will the New President Change Taxes for the Wealthy?

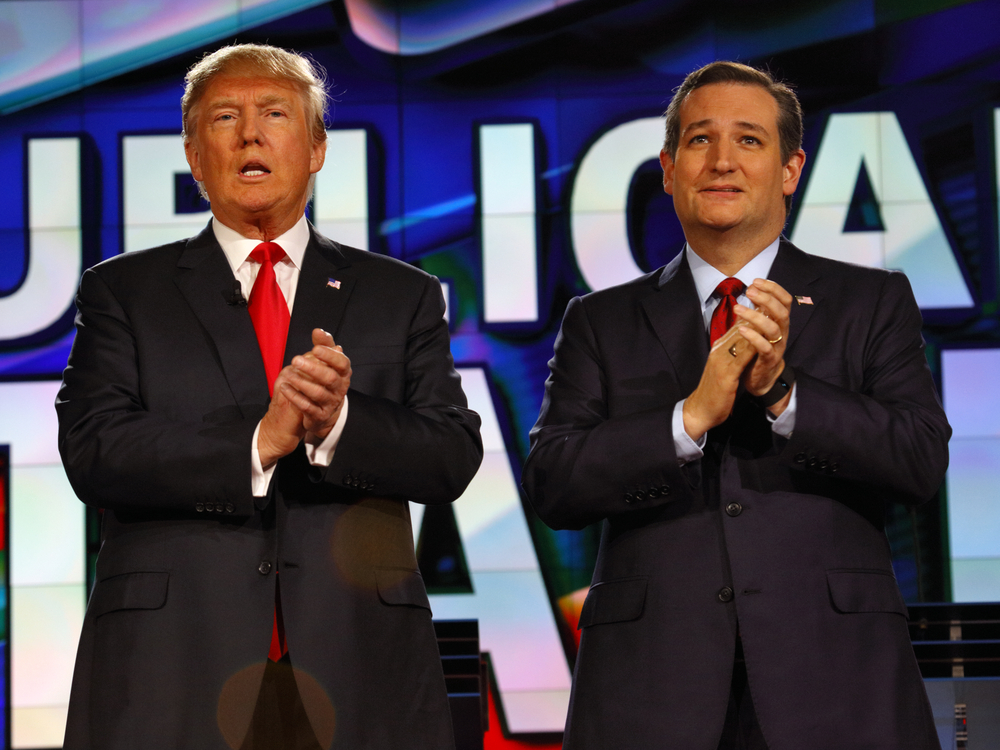

So which side are you on? Trump, Cruz, Clinton, Sanders, a write-in candidate, or are you still hoping for an optional third-party independent candidate? The fact is, when it comes to taxes, no matter which candidate you vote for, things will likely be changing for the nation’s wealthiest taxpayers in 2017. Whether or not you see those changes as positive or negative depends on which side you fall on.

The Tax Policy Center has released some interesting numbers that give a good picture of how the wealthy will be affected based on who is elected as our country’s next president. The general picture is that if a democrat candidate is chosen then the tax system would become more progressive and the wealthy would be hit harder. On the flip side, if a republican wins the nomination then revenue would be cut and the tax system would take on a more regressive approach.

Here is how the top candidates’ plans would affect the wealthy:

- Bernie Sanders – households that fall into the top 0.1 percent would see an increase of more than $3 million in taxes on average in 2017.

- Hillary Clinton – households in the same income level would pay an additional $500,000 more.

- Ted Cruz – households in the top 0.1 percent would see taxes cut by $2 million.

- Donald Trump – households in the highest income level would see taxes cut by $1.3 million.

Whoever the country elects as its next commander in chief, the majority of taxpayers will be affected one way or another. If you count yourself among the nation’s wealthiest, then you will feel that change even more, for better or for worse.

How to Choose Your Tax Filing Status if You’re Married

If you’re married then you’ve probably just always filed a joint return with your spouse. In fact, chances are you’ve never even considered filing any other way. However, for some people, married filing jointly is not the best option. Depending on your situation, it could be more advantageous to file separately. Here are some things…

IRS Has Handed Out More Than $100 Billion in Refunds so far

As with every tax season there have been some mistakes that have caused problems for some taxpayers, as well as the usual battle with tax scams that pop up every year. However for the most part, the refund process has gone well to this point. In fact, at the end of February, the IRS reported…

There Is a Bright Side for Early Filers Victimized by Obamacare Gaffe

There’s been no shortage of complaints and problems with Obamacare since the nations new health care coverage law went into effect. In fact, the debate continues to rage on and another major decision from the U.S. Supreme Court is forthcoming in the months ahead. However, for the time being, Obamacare has been a problem for…

Should You Pay Estimated Taxes?

For most people tax time only comes once year. However, for anyone who has to pay estimated taxes a large tax bill could be due several times a year. Again, most people do not have to worry about paying estimated taxes, but there are several circumstances that will put you in that category. The most…