Making the Most of Corporate Tax Reform

Although nothing major has happened yet, rest assured that corporate tax reform is on the way. The Trump administration has made big promises and at some point they are coming. So far, the president has proposed reducing the corporate tax rate from 35 percent to 15 percent, while republican leaders in Congress have proposed a slightly more modest reduction to 20 percent.

Either way, the cut would represent a significant reduction form the current rate of 35 percent and corporations would see a huge boost. For example, if the effective tax rate dropped to 8.4 percent, then S&P companies would see the amount of pretax income they keep jump to about 85 percent from the current amount of about 76 percent.

The president has also proposed a repatriation rate of only 10 percent. In other words all the corporate income that companies are currently holding overseas in order to avoid the 35 percent U.S. corporate tax rate would only be charged a 10 percent rate if it were brought home to the U.S. There could also be a removal of the interest-deductibility, which could actually hurt earnings, but the tax breaks would far outweigh the losses.

Therefore, if you add it all up you get a lower corporate tax rate that would boost earnings by about 11 percent combined with a repatriation rate that would boost earnings another 2 percent. Removing the interest-deductibility would lower earnings by 2 percent, therefore leaving a net boost of 11 percent to S&P 500 earnings.

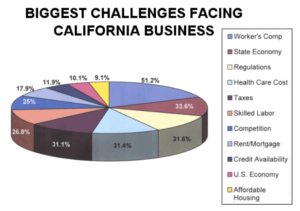

Survey: Biggest Challenges Facing California Businesses

Survey: Biggest Challenges Facing California Businesses A recent survey was conducted to determine what business owners in California thought the biggest challenges facing their businesses were. Out of 1500 questionnaires, these are the percentage of respondents who checked off a box next to each challenge. (Respondents were allowed to select more than one box, so…

5 Strategies to Successful Cash Flow Management

5 Strategies to Successful Cash Flow Management By John Reddish How can you predict, avoid and/or, minimize the impact of a cash emergency? Managing cash flow is every manager’s challenge, every day, every year. Those managers who keep a close eye on their daily activity and emerging industry trends can help reduce their company’s exposure…

15 Tips to Streamline Your Business and Become Profitable in 2007

15 Tips to Streamline Your Business and Become Profitable in 2007 By Julian Stone Here are some tips to help you ‘cut the fat’ and improve the productivity of your business. If you apply a few of these, you’re well on your way to achieving greater profit and creating less stress! Cut the SlackersCut the…

10 Ways to Increase Your Profitability

10 Ways to Increase Your Profitability “Profitability is as dependent on cutting costs as it is on increasing sales.” Profitability is as dependent on cutting costs at it is on increasing sales. As financial advisors, we are often called upon to assist management in reducing costs and finding alternatives to their unique situations. We have…