Mansion Ends Up Getting Owner in Hot Water for Tax Evasion

Is it possible to hide anything from the IRS? Even when you think you’re safe, it appears the IRS has an eye in the sky. That eye seems to be all reaching, at least in Pennsylvania. A wealthy real estate developer and CEO of Automated Health Systems owns a luxurious 32,400 square-foot mansion that apparently caught the eye of IRS agents flying in and out of Pittsburgh.

After authorities began to ask questions that eventually lead to the mansion owner’s personal secretary ending up in some serious trouble. That’s because the secretary, who also acted as the bookkeeper for her boss, recently pleaded guilty to tax evasion, which reportedly could be as much as $250 million. The mansion owner has not been charged in the case at this point and his attorney claims that the case is nothing more than a tax dispute.

However, the attorney for the secretary claims that his client was only following her boss’ direction and simply did what he directed her to do. He did concede that it was still criminal activity and his client is aware of that. The scheme reportedly involved re-characterizing her boss’ personal expenses to appear as business expenses. Formal charges include “conspiracy to fraudulently pay for and unlawfully deduct as business expenses, millions of dollars in personal expenses of co-conspirator 1.” It would appear that “co-conspirator 1” is her boss, although he has yet to be named.

The lesson here is if you’re going to build a big mansion, make sure it’s nowhere near a major airport, or else the eye in the sky might decide to take a closer look.

2X Wealth Group: Investment Management Catered to Women | Lori Zager

“2X Wealth Group: Investment Management Catered to Women”, Lori Zager Transcript, Interview by Alan Olsen, Host of The American Dreams Show: Alan Olsen: Welcome back. I’m here today with Lori Zager. She is the co founder of the 2X Wealth Group which is a subsidiary of Ingalls & Snyder. Lori, welcome to today’s show. …

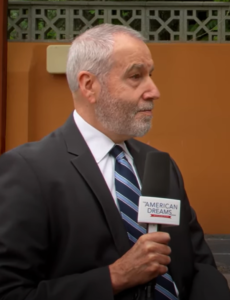

John Hoffmire

Transcript of John Hoffmire: Alan Olsen: One of the areas that you’ve been involved with is impact investing, what is impact investing? John Hoffmire: Well, impact investing can be defined as a number of different ways. I’m going to define it in the broadest possible way, where investments of almost all types make an…

Add These Leadership Skills for 2021

As we begin to exit the pandemic, are you looking to grow or enhance your leadership skills this year? If so, it is vital to have a plan as no one can expect to become a better leader just by showing up every day. Here are some important things to focus on in 2021. These leadership…

Workplace Accountability in Four Steps

Have you encountered a co-worker, boss or employee, who slacks off, unloads their work onto others, or takes credit for work and ideas that are not their own? Accountability in the workplace can often seem a bit too scarce, especially when the competitive drive kicks in. Or perhaps, someone that works hard, but never seems…